Ha, never mind. Seems to have calmed down. This new format caught me. Still adjusting to how threads appear.

US Customs and FDA are Attacking Pipe Smokers

- Thread starter tiberiusjones

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

- Status

- Not open for further replies.

Wait what.. Texas...no no no..it was supposed to go the VA. PM sent!Just mailed a bag of Penzance to Texas this morning. Looking like gifting may be the only way to avoid taxation...for now.

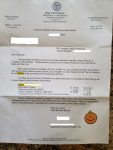

View attachment 5715

Puff: )

Has anyone else received a Tax due letter from your State? At least the person has a sense of humor with the "jack o lantern" sticker... I also buy from the other sites as most do here...so I am not sure why this one triggers a out of state transaction.Ha, never mind. Seems to have calmed down. This new format caught me. Still adjusting to how threads appear.

Money grubbers.

I bet that the oversight, generation and accounting of this letter sent to you cost your state more than the tax being levied.

I completely understand their intervention if they see an abuse of their statutes at a wholesale purchasing level, but to send out a letter to a guy that bought a hundred bucks worth of cigars? Petty....

Time to move.....

I bet that the oversight, generation and accounting of this letter sent to you cost your state more than the tax being levied.

I completely understand their intervention if they see an abuse of their statutes at a wholesale purchasing level, but to send out a letter to a guy that bought a hundred bucks worth of cigars? Petty....

Time to move.....

throw them letters in a trash bin,You have never received one,sometimes letters tend to go missing ,,

Although I deeply despise the willy-nilly use of "Nazi" that's become so thoughtlessly popular these days, I suppose it's no different than calling someone a Neanderthal or, worse yet, "Bloody Viking"

"I am not sure why this one triggers a out of state transaction."

Really? The vendor likely reported your transaction. Doing so is probably required if they wish to do business in your state.

States, and here in Alaska municipalities with sales tax, are not going to stand idely by and let moneys go uncollected. Consumers have skated for many years. As local retailers are closing, governments are forced to recover losses by collecting from e-commerce transactions. There should be no surprise or even rightous indignation (real or fake), at this state of affairs. Even the "simple minded" knew it was coming.

Really? The vendor likely reported your transaction. Doing so is probably required if they wish to do business in your state.

So, did they misinterpret the law or is it not written to your preference? The State simply wants what they are losing through inter-state commerce. One party is trying to avoid taxes, the other is simply trying to collect their "fair share" as established by the law makers.I completely understand their intervention if they see an abuse of their statutes at a wholesale purchasing level, but to send out a letter to a guy that bought a hundred bucks worth of cigars?

States, and here in Alaska municipalities with sales tax, are not going to stand idely by and let moneys go uncollected. Consumers have skated for many years. As local retailers are closing, governments are forced to recover losses by collecting from e-commerce transactions. There should be no surprise or even rightous indignation (real or fake), at this state of affairs. Even the "simple minded" knew it was coming.

It's the small tobacco dealers and some other small retailers who cause the problems for the states. Amazon seems to collect the taxes for the states. Hence, no problem with collection. Other large net presences do the same, collect the time of sale. Small tobacco dealers appear to either ignore the situation at their own peril or push the responsibility onto the consumer.

Your state wants its moneys. If you are unaware of your state's position with regard to sales and tobacco taxes ... prepare yourself for a surprise, probably sooner than later.

Your state wants its moneys. If you are unaware of your state's position with regard to sales and tobacco taxes ... prepare yourself for a surprise, probably sooner than later.

And tens of thousands that do with the numbers growing. The tobacco tax collection for out of state purchases isn't new. The increased efficiency is. It's still hit or miss but, trust me, the states will improve collection as time goes by. Retailers will either collect at time of sale or inform the state when a taxed item is sent into the jurisdiction. Small retailers will find it easier to collect names, addresses, amounts, etc. and inform the states a couple times a year.

Remember the old adage regarding the only two things certain in life, death and ... taxes. We all knew or, should have known the free ride (tax avoidance) was but a temporary phenomenon. Caesar will get what is rightfully Caesar's.

Remember the old adage regarding the only two things certain in life, death and ... taxes. We all knew or, should have known the free ride (tax avoidance) was but a temporary phenomenon. Caesar will get what is rightfully Caesar's.

I'll never get that 2:25 seconds back, sir. Never.Although I deeply despise the willy-nilly use of "Nazi" that's become so thoughtlessly popular these days, I suppose it's no different than calling someone a Neanderthal or, worse yet, "Bloody Viking"

But if you always are smoking a pipe, there's no such thing as wasted time!I'll never get that 2:25 seconds back, sir. Never.

Now, what blend goes best with Spam, egg, sausage and Spam?

@warren: I already understood all of that.

My question remains the same however:

It would be interesting to know if anyone has ever received one of these letters for internet purchases of anything other than tobacco. Somehow I doubt it.

Probably the most important comment in this thread thus far.

My question remains the same however:

It would be interesting to know if anyone has ever received one of these letters for internet purchases of anything other than tobacco. Somehow I doubt it.

But if you always are smoking a pipe, there's no such thing as wasted time!

Probably the most important comment in this thread thus far.

A fair point. If Spam, egg, sausage, and Spam is to be had, there must be coffee involved. My favorite blends with coffee after breakfast are Dunhill Navy Rolls, Dan Tobacco Salty Dogs, GH Dark Flake Unscented, or GH Dark Bird's Eye.But if you always are smoking a pipe, there's no such thing as wasted time!

Now, what blend goes best with Spam, egg, sausage and Spam?

Since a meal containing Spam can only be described as De Luxe, I will have to go with the Dunhill Navy Rolls. I sometimes toss in about 10% Seattle Pipe Club Plum Pudding when I smoke this blend for a little hint of Latakia and sweetness and it's great.

Dammit, now I want Spam, coffee, and Navy Pudding for dinner. Alright maybe it wasn't a total waste of my time.

So, did they misinterpret the law or is it not written to your preference? The State simply wants what they are losing through inter-state commerce. One party is trying to avoid taxes, the other is simply trying to collect their "fair share" as established by the law makers.sandollars said:

I completely understand their intervention if they see an abuse of their statutes at a wholesale purchasing level, but to send out a letter to a guy that bought a hundred bucks worth of cigars?

States, and here in Alaska municipalities with sales tax, are not going to stand idly by and let moneys go uncollected. Consumers have skated for many years. As local retailers are closing, governments are forced to recover losses by collecting from e-commerce transactions. There should be no surprise or even righteous indignation (real or fake), at this state of affairs. Even the "simple minded" knew it was coming.

Ahh. I see what clever thing you did there. You completely (intentionally?) missed my point for it was in the previous sentence. The one you omitted.

In my line of work I often get misquoted by individuals for self serving purposes.

I do not begrudge my Government their required funds through my taxes to supply the services which We, The People, contract them to supply. Nay, not one penny. I happily pay my taxes.

I have been all over this big world and I am so lucky to have been born and raised in the country which I live. What infuriates me is when I see flagrant waste brought on by ignorance and mismanagement of the taxes that I pay.

If a cop is standing in front of 2 individuals, one committing a murder and the other shoplifting, Which offense should he pursue First? Which would yield the best net effect? Surely the shoplifter would be an easier collar but I suggest it should be the murderer. Same, same, only different...

BTW, I corrected a couple of spelling errors you missed in your comments. My simple mind is too meticulous for its own good sometimes.

Just helping out..

Last edited:

- Status

- Not open for further replies.