Hawai’i Ban on Shipping

- Thread starter Akoni808

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

In most states, people ordering online don't pay the excise tax if the company isn't in your state. It's a reason why online purchases are often cheaper than your local B&M (and also a reason why a B&M may complain about online ordering because it's tough to compete).

If you currently buy a 2oz tin of Union Square of Smoking Pipes for $12.96 and you only pay the state sales tax on checkout, you are not paying the 70% Hawaii tobacco excise tax compared to if you bought the same 2oz tin at a B&M locally who has to charge it. The excise tax is an additional, special tax on top of the sales tax specifically for the type of tobacco you are purchasing. Every state is different on what they charge for the different types of tobacco.

Ok, so yes, if SPC never had to pay the 70% to Hawaii in the past, they might pay that now, because the Tax Department said there might be additional fees, which I’m still not sure on, if that meant, if your volume of sales is lower, than you don’t pay the 70%. hmm

I guess what Hawaii was trying to explain, is that this has not changed for a local business, they’ve always had to pay this.

Last edited:

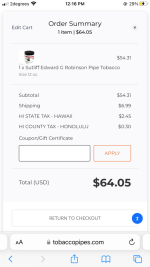

for clarity’s sake (would have used SPC but they no longer let you add a Hawaiian address for tobacco)

View attachment 231999

Ok, this doesn’t look like a 70% ge tax...

Correct, so if that vendor made the change, I'd expect an additional line item for the excise tax for an additional $38.02.for clarity’s sake (would have used SPC but they no longer let you add a Hawaiian address for tobacco)

View attachment 231999

I spoke with the Tax Department again, because I didn’t consider the 70% GE, which already exists for a local business.Correct, so if that vendor made the change, I'd expect an additional line item for the excise tax for an additional $38.02.

So yes, online vendors may very well have to pay the 70% GE to Hawaii and online tobacco prices are going up. hmm

I’m waiting for the Tax Department to get back to me on this.

A

AroEnglish

Guest

When I checkout from SP or TP my state excise tax gets automatically added. It’s been like that for maybe a year or so. I don’t like the tax but so long as it’s in place I’ll pay it rather than circumvent it.

When I checkout from SP or TP my state excise tax gets automatically added. It’s been like that for maybe a year or so. I don’t like the tax but so long as it’s in place I’ll pay it rather than circumvent it.

If we are talking about the screen shot Ahi Ka posted showing Hawaii, for Hawaii, we only paid in the past a Sales Tax and County Tax not the 70% GE Tax for online purchases.

A 70% GE tax is only applied on local sales.

A

AroEnglish

Guest

Yup, what I meant was that I think SP will work it in eventually as they were one of the first to start adding the appropriate excise tax.That’s a HI Sales Tax and County Tax, like the screen shot Ahi Ka showed, not the 70% GE Tax.

Yup, what I meant was that I think SP will work it in eventually as they were one of the first to start adding the appropriate excise tax.

But Holy Crap pipe tobacco is now going to be 70% higher, sheesh, I hope not...

A

AroEnglish

Guest

Yeah, unfortunately that’s probably going to be the case. A big blow for sure but much better than no tobacco at all, right?But Holy Crap pipe tobacco is now going to be 70% higher, sheesh, I hope not...

A

AroEnglish

Guest

A

AroEnglish

Guest

Another revolution you say? SC has a 5% excise tax but if we all move there we could not only vote that to become 0%, we could also have other industries taxed higher and subsidize tobacco farmers. And Sykes will be the GEOTUS of Tobaccolina (formerly SC). We would also have flying cars and monkey butlers.Ok, I’m bloody confused here! LOL

Hello, didn’t we leave England because of unfair taxes, and come to the land of freedom to escape this! LOL

Holy Crap, is this the 1700s all over again.

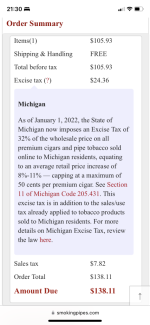

View attachment 232019

A

AroEnglish

Guest

Still better than my home and native land where tax is $0.65 per gram. $32.50 tax on a 50g tinWow SC only a 5% GE, Hawaii’s 70% is just ridiculous...

Plus it’s not 70% tax on the list price but the wholesale purchase price.

Just get your orders sent via a friend who lives in a state with lower taxes. Chuck in a few tins for them. Done.

Still better than my home and native land where tax is $0.65 per gram. $32.50 tax on a 50g tin

Plus it’s not 70% tax on the list price but the wholesale purchase price.

Oh, 70% on Wholesale... hmm ok, I’ll follow up on that, in regards to retail GE...

A