C. R. S. Lyles

In addition to the strain of added taxes and its almost "guilty by association" nature, pipe tobacco is now facing a renewed threat (initially from 2010) to its survival in the form of loose tobacco being reclassified as pipe tobacco in order to avoid state and federal taxes. According to estimates published by the Orlando Sentinel, the Ithaca Journal and USA Today, the money lost in federal and state taxes due to the roll-your-own (RYO) reclassification of loose tobacco as pipe tobacco by switching the labels equaled roughly $615 million to over $1 billion federally and over $60 million in Florida alone from April 2009 to August 2011.

In addition to the strain of added taxes and its almost "guilty by association" nature, pipe tobacco is now facing a renewed threat (initially from 2010) to its survival in the form of loose tobacco being reclassified as pipe tobacco in order to avoid state and federal taxes. According to estimates published by the Orlando Sentinel, the Ithaca Journal and USA Today, the money lost in federal and state taxes due to the roll-your-own (RYO) reclassification of loose tobacco as pipe tobacco by switching the labels equaled roughly $615 million to over $1 billion federally and over $60 million in Florida alone from April 2009 to August 2011.

Of course, the general public takes these dollar figures as fact, and doesn’t recognize them as the speculative estimates that they truly are. This is usually the case with any type of made-up numbers being presented as facts to vilify tobacco. The population at large swallows them whole instead of perceiving them for the politically motivated hyperbole that they are.

This information was released in a report last month by the Centers for Disease Control and Prevention (CDC), and it claims that, after Florida, Texas was the second state to lose the most tax revenue (over $30 million) due to the nearly $22 difference per pound between RYO and pipe tobacco.

According to the Ithaca Journal, New York lost approximately $17 million in state taxes for the same issue, which has resulted in levying the total blame for between roughly $700 million and over $1.2 billion in lost tax revenue wholly upon tobacco. Again, quite dubious calculations.

The whole issue began initially with a Government Accountability Office (GAO) report citing "large federal excise tax disparities among tobacco products" resulting from the Children’s Health Insurance Program Reauthorization Act (CHIRPA) of 2009.

What the GAO meant by "large federal excise disparities" is that from January 2009 to September 2011, monthly sales of pipe tobacco increased from approximately 240,000 pounds to over 3 million pounds, while RYO tobacco decreased from roughly 2 million pounds to 315,000 pounds in the same time period. Simultaneously, large cigar sales increased from 411 million to over 1 billion, and small cigars dropped from approximately 430 million to 60 million.

What the GAO meant by "large federal excise disparities" is that from January 2009 to September 2011, monthly sales of pipe tobacco increased from approximately 240,000 pounds to over 3 million pounds, while RYO tobacco decreased from roughly 2 million pounds to 315,000 pounds in the same time period. Simultaneously, large cigar sales increased from 411 million to over 1 billion, and small cigars dropped from approximately 430 million to 60 million.

While this boost in the numbers of pipe tobacco consumption could just be attributed to pipe tobacco "coming back into style", the more likely answer lies in the RYO reclassification, which in turn is leading to further problems for tobacco, created from within.

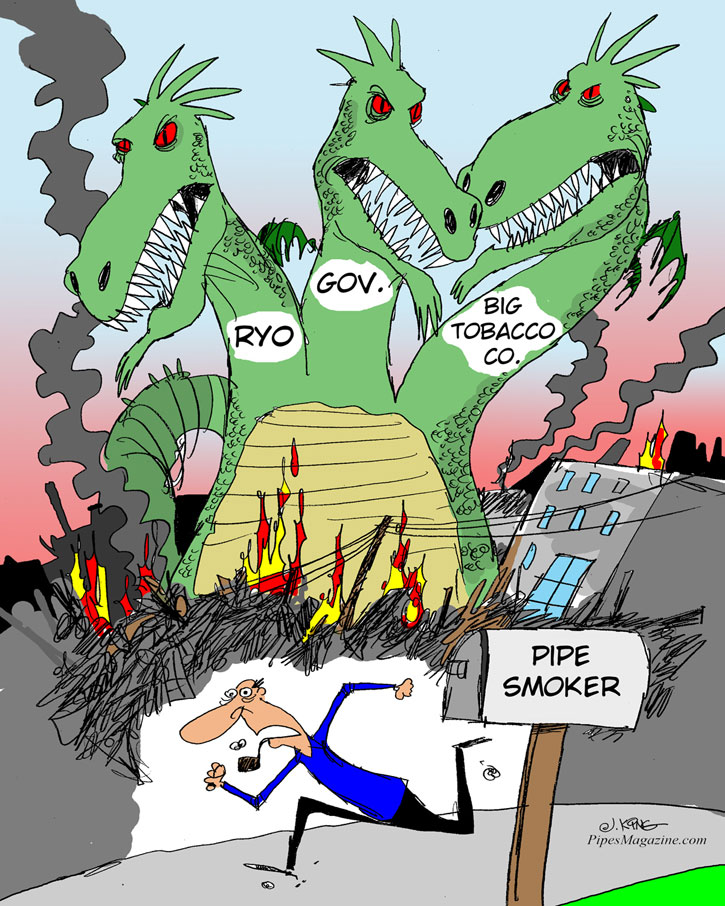

"The pipe tobacco industry and pipe smokers themselves are innocent victims, caught in the cross-fire of a multi-player civil war inside the tobacco industry itself, along with the traditional outside enemies firing shots as well. Big Tobacco has allied itself with Big Government in an effort to kill off its’ competition—that of roll-your-own retail outlets. At stake; are sales dollars, tax dollars, and an entire niche industry … with the potential unintended casualty being the entire pipe tobacco business."

Godbee says that it is really specific elements within the RYO retailers which are causing so many problems for pipe tobacco, elements such as the roll-your-own cigarette machines which USA Today reported were being "installed in neighborhood smoke shops around the nation."

"[It’s] resulted in opportunist retailers [popping] up like dandelions at springtime pumping out cheap cigarettes, not only avoiding RYO taxes with fake pipe tobacco, but also avoiding cigarette manufacturing taxes," Godbee said.

This loophole in the tobacco tax codes are certainly helping RYO to recoup the revenue they’ve lost over the past three years due to the 2,000% tax increase, but this is being done at the expense of other tobacco products, both financially and interpersonally.

Responding to similar issues internally, several states, including Iowa, Washington, Oklahoma and Tennessee have passed legislation aimed specifically at RYO cigarette machines in an attempt to get back what they deserve in tobacco tax revenue.

"The Washington bill signed into law by the governor will level the playing field between RYO machine operators and traditional cigarette retailers by equalizing the tobacco tax paid by RYO store operators with the state’s $3.02 per pack cigarette tax," said Thomas Briant, executive director for the National Association of Tobacco Outlets (NATO) in an interview with CSP Daily News. "The RYO law enacted in Iowa is similar in that it requires RYO machine operators to pay a per-stick state excise tax. In Oklahoma, the bill passed by the legislature and sent to the governor for consideration would ban the use of commercial RYO machines except in adult-only, age-restricted facilities and require the operator to obtain a federal permit from the Alcohol & Tobacco Tax & Trade Bureau to operate as a cigarette manufacturer."

And while this would go a long way to helping alleviate some of the problems due to the confusion between RYO and pipe tobacco, you can bet that there will be problems aplenty somewhere down the line.

The seeds of this whole issue, though, can be traced back to the anti-tobacco laws and acts which swarmed Congress in 2009, the majority of which were initiated in the name of "health insurance for needy children" (even though multiple reports dating from 1998 all the way to 2010 published in Business Week and the FDA’s Adverse Reporting System stated that the programs that were supposed to be being funded by tobacco tax and settlement money were woefully under-funded and that 77% of the "needy children" they were really targeting with these initiatives already had private health insurance).

Unfortunately, though, it’s become evidently clear over the past several years that as soon as anyone says they’re doing something for the cause of "needy children", the public tends to tune out whatever comes next, and that’s exactly what’s occurred again.

In a Washington press release last month, U.S. Sen. Dick Durbin (D-IL), Sen. Frank Lautenberg (D-NJ) and Sen. Richard Blumenthal (D-CT) announced that they had joined forces to produce the Tobacco Tax Equity Act, which they claimed was aimed at "[closing] loopholes in the tax code that allow tobacco companies to avoid the federal cigarette and roll-your-own (RYO) tobacco tax."

In a Washington press release last month, U.S. Sen. Dick Durbin (D-IL), Sen. Frank Lautenberg (D-NJ) and Sen. Richard Blumenthal (D-CT) announced that they had joined forces to produce the Tobacco Tax Equity Act, which they claimed was aimed at "[closing] loopholes in the tax code that allow tobacco companies to avoid the federal cigarette and roll-your-own (RYO) tobacco tax."

And, right on cue, Durbin announced in his very next quote that:

"The current loopholes in the taxes on tobacco products encourage the use of products like pipe tobacco, smokeless tobacco, and ‘nicotine candies’ as a cheap source of tobacco, particularly among young people. This difference in tax rates doesn’t make sense, and we are already seeing tobacco manufacturers abusing them by changing the labels on their products to avoid paying the higher tax. This bill will stop tobacco manufacturers from gaming the system and protect more children and teens from this dangerous habit."

The only real response that can be levied against Durbin’s agenda is to demand him and his cronies to produce a teen who is hopelessly addicted to pipe tobacco.

Besides that, though, he’s right about a number of the other issues—just as Godbee stated previously, there are opportunists out there who will "game the system", but as pipe tobacco has been trying to prove for years now, lumping all tobacco into one category and assuming that they’re all going to try and "game the system" in order to "get kids addicted" shows not only personal ignorance, but a vehement apathy against overcoming this lack of knowledge and truth.

Apparently, though, they just don’t care.

According to Godbee; "The Government, in a far overreaching and completely illogical, but convenient manner of picking on ‘evil tobacco’, drastically increased taxes on RYO as part of the implementation of S-CHIP in 2009. This is health insurance for needy children being funded by an over 2000% increase on roll-your-own tobacco. There were different increases on all forms of tobacco, but RYO had the largest. At the time, pipe tobacco taxes went up over 150%.

This only caused more problems for everyone on both sides when RYO found the loophole to mislabel their product as pipe tobacco. This resulted in opportunist retailers pumping out cheap cartons of cigarettes with new automated rolling machines, not only avoiding RYO taxes with fake pipe tobacco, but also avoiding cigarette manufacturers taxes."

"The solution most often proposed (and currently being pushed) is to make the tax on pipe tobacco the same as RYO—an increase from about $3 per lb. to $25 per lb. What’s colossally ridiculous is that for 2-years running it’s been ‘Groundhog Day’ and ‘Déjà vu all over again’."

"When this proposed solution first came up two years ago, it was explained how the real pipe tobacco industry would be put out of business because we are way too small of a niche to survive such a drastic increase in taxes. Further, the industry gave a better solution that would solve the problem, without having real pipe tobacco becoming extinct and putting companies out of business and employees out of work."

"The root of the loophole being exploited is that the only definition the government has for pipe tobacco is that if the package says it’s pipe tobacco, then it is pipe tobacco."

"The real pipe tobacco industry got together (2-years ago) and came up with a specific, scientific definition that made a clear, concise differentiation between real pipe tobacco and fake pipe tobacco that is really RYO."

"The TTB (Alcohol and Tobacco Tax and Trade Bureau) provided a public commentary period in 2010, and the Pipe Tobacco Council’s definition for pipe tobacco was submitted … and ignored."

"We gave them a real solution that would solve the problem, and it was ignored back then, and continues to be ignored now."

So, unfortunately, it seems that there may be a day in the future when pipe smokers of America are going to have to run for lives / lifestyle-preferences if they are to truly enjoy the freedom’s which this country proposes to support. With enemies arising from within and without, it’s becoming harder and harder to ignore the feeling that the enemies of pipe tobacco are moving in for the kill.

"There have been several times that proposals to increase the pipe tobacco tax have been defeated, but they keep coming back over, and over, and over again," Godbee said. "We gave them a solution. They ignored it. We defeated their draconian proposals several times over, and they keep bringing them back. It’s utterly ludicrous. And scary."

Related News: Swisher Laying Off 150 – Cigar maker cites government regulation

Stay tuned to the pages of Pipes Magazine to stay current on the legislative front of pipe tobacco.

Carter R. Lyles is a student at the University of Central Florida in Orlando, FL and at the University of Florida in Gainesville. He is a journalism/psychology major, and in addition to his work at Pipes Magazine, he has contributed articles to Cigar Chronicles, The Alligator, Thursday Night Magazine, and The Fine Print. Carter R. Lyles is a student at the University of Central Florida in Orlando, FL and at the University of Florida in Gainesville. He is a journalism/psychology major, and in addition to his work at Pipes Magazine, he has contributed articles to Cigar Chronicles, The Alligator, Thursday Night Magazine, and The Fine Print. |

The very concept that “government is ‘losing’ income (taxes) because…” someone else is not paying their “fair share” is ludicrous. This country was founded on resistance to unfair taxation.

They’re just using the ‘ex-wife syndrome’ tactic of “guilt” to have their way with us. They’re not “losing” anything. They just need to fulfill their bloated & wasteful spending budgets for their checks to clear the bank. Pipe smokers are just an overlooked & heretofore “under-taxed” group that are NOT doing their “fair share”. Implying that what non pipe-smokers must pay extra taxes to make up the slack.

Implying that pipe smokers are slackers that don’t pay their ‘fair share’ of taxes. A simple ‘divide & conquer’ tactic. WAKE UP AMERICA!

As I’ve said for quite some time, Big Tobacco is the bane of pipe and cigar smokers.

Just curious, what are some of the formerly RYO tobaccos that have been re-classified as “pipe tobacco”?

Big oil, big tobacco, guns kill, evil fast foods, talk about a nanny state. Wouldn’t it be nice if all these congressman and senators, government workers,would just disappear and we could start all over again.

Oh to dream.

Since good quality pipe tobacco properly maintained improves over time, I suggest you buy all you can, while you can. The same thing for ammo where you are able. There may come a time when a tin of tobacco, or a box of ammo might be worth a great deal.

I believe George Washington in a letter to the continental congerss said if you can’t send money send tobacco.

Well written and chillingly accurate article. I wish it wasn’t true but it is true and we’ve all seen it going on. Sadly, the stage is set with the current political climate and a gullible population. We are seemingly on a course of impending taxation that will put the US on a par with the UK and Europe. If this comes to pass, then I fear a return of many socially counterproductive behaviors and events, such as the prohibition spawned.

Thank you for another great Article. I’d like to know the “… specific, scientific definition that made a clear, concise differentiation between real pipe tobacco and fake pipe tobacco that is really RYO.”

Thank you for this excellent article. It is extremely well written and an accurate representation of current events! Pipe smokers will suffer. We are a minority to be sure! The proverbial Government shooting off their own foot is in the works and not to be underestimated. Can we turn it around? I say it is too late as a result of one thing. The tobacco manufacturers (the BIG GUYS) is what I am talking about. Even they don’t care about us. They just wnat to survive any way that they can. They have pursued the “loophole” and it will not work. But, they will do whatever they must to avoid the inevitable for as long as they can and still turn a profit. We pipe smoker’s will be lost in the cross-fire. So, what is the answer? One cannot fight greed and it will be the tobacco industry downfall. I can’t blame them. But, the outcome is obvious. Anti-smoking is popular with the populous and it is politically expedient to the politician. We lose! There will be no consideraton for us pipe smokers. The battle is lost. That being said, let us not forget that Prohibition of alcohol did not work. This won’t work, either. Pipe smokers will continue to smoke their pipes and eventually what goes around, comes around and we will prevail in a manner of speaking. After all the damage is done, we may be paying as much for an ounce of tobacco as we do for a gallon of gasoline. Actually, we are there now! So, plan to spend lots of money for tobacco taxation and you eventually will be able to smoke your pipe in your home (only) at a very high cost. The next ten years is going to be very tough for all of us!

As more and more young college students pick up the pipe, I think public opinion way change again in the not too distant future. The most difficult thing will be for the pipe tobacco industry to survive until then. Thanks for the insight and the great article.

Taxing pipe tobacco at the RYO rate simply because RYO producers have relabeled their product is asinine. If RYO producers had relabeled their product as salad herbs, that same lack of logic would drive legislators to tax parsley at the RYO rate!

With universal healthcare here in Canada, taxes on cigarettes are needed to offset healthcare costs…not so much in the U.S…..the solution is simple…tax the hell outta cigarette papers.

In the EU they have tried to set a minimum width of ribbon cut for pipe tobacco so that it is more difficult for RYO tobacco. I bought from England a pouch of Capstan and on it was an announcement of a minimum width. Maybe all pipe tobacco should become flakes, cakes and ropes. I would not be unhappy.

I have noticed a lot of people blaming Big Tobacco, RYO industry, cigarettes, etc. for this huge taxation problem, but no one is looking at the real culprit – GOVERNMENT. These idiots in congress have screwed up their budgets and are NEVER, EVER held accountable for it so they do what is easy for them – tax every business out of existence that they don’t like. And they will get away with it because most people are either to ignorant of the facts or feel they can’t do anything about it. All these worthless politicians need to do is say “it’s for the children” or “its a health issue” and then raise those taxes as long as it doesn’t affect THEM or their BUDS. That’s what politicians do because, as I said before, they know they can get away with it. If people need more evidence of this, look at how they have almost destroyed Social Security by using the funds for everything EXCEPT what it was designed to do!

Better stock up gentlemen. Now we got a whole new product to smuggle, so at least get enough to last ya till Dec. when the Earth is gonna fly out of orbit, according to them Mayan dudes…

One thing that the taxpayers (smokers and non-smokers) need to look at is if the tobacco companies (Big Tobacco and RYO and Pipe tobacco companies) are destroyed by these ever increasing taxes, where is the lost revenue going to come from? The government is not in the habit of adjusting their budgets to take into account these lost revenues, so they simply raise taxes somewhere else. Eventually, all people will be paying higher taxes to make up the revenue. This revenue will probably come in the form of higher income taxes or sales taxes.

There is a side issue here that most people miss. Have you heard the news about the

very costly {in money and lives} war on drugs in Mexico? I can remember way back when

when most college age students assumed it was inevitable that marijuana would be

legalized. And people say why do governments not legalize drugs for taxes? I say it

is because these corrupt politicians make more money in pay-offs and bribes on the

illegal drug trade. Further I believe most of your anti-tobacco politicians today do

not smoke tobacco and judging from their logic and disdain for tobacco smokers believe

many of them are smokers but what they are smoking is weed. Are the drug cartels

pushing the anti-tobacco and tax tobacco to death paradigm so as to get more people

to smoke pot instead?

Quit blaming the victim.

I’m curious. How can those states “lose” that money if they never had it?

Well written. Unfortunatly if we can’t get to the real anti-tobacco fanatics driving all this nobody will listen. More so since there’s money to be made by jumping on the anti-tobacco wagon.

As a cigar smoker (I smoke pipes too), I hear the same fears being voiced about government restrictions and declining freedoms. I dont know if there is an organized group that lobbies for the pipe industry, but I support the Cigar Rights of America. They are working to create legislation to keep the FDA out of regulating the cigar industry. I know the pipe tobacco industry isnt exactly the same, but we’re all seeing our freedoms go up in smoke.