I noticed that too but didn't pull the trigger.So I placed an order from a certain Squire today, and got a shipping number already, payment went through, no 71% tax.

Wisconsin Sales Tax on Tobacco Starting Jan. 1, 2025

- Thread starter Singularis

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

Good question, and I'm not sure. CS had a couple house blends I wanted to try, so I put them in my cart, went through the checkout process looking for the tax to pop up at some point in the process and it never did. It may be up to each state, maybe the individual companies decide if they want to comply or not, maybe they aren't aware of the new change as of Jan 1st. Just kind of thinking out loud here.Does MS, like VA, not collect other states' taxes?

It might be a nice idea for some retired fella with more time than me to check and see which shops apply the tax to the order by going through the checkout process and not hitting that final submit order button. And people can do with that information what they will. As of now I'm well stocked up on tobacco, but who knows, maybe next week I'll really want to try a different blend.

So, I wouldn't advocate or try to dissuade anyone from dodging taxes. I wouldn't be entirely surprised either if there's some kind of mechanism in place with credit card companies or PayPal to forward out of state purchase information to state departments of revenue. If I end up owing tax on my purchase somehow I'm not going to get upset about it. Maybe it's like rolling the dice in the era we live in now. And everybody will have to make their own decisions.I ordered a few samples from the Squire in December, and sure enough: no tax

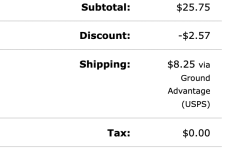

View attachment 363622

I may have to rethink some of my tobacco sources.

But I'm curious to see which shops will apply this tax. I might start digging into this tonight after I sleep, more out of curiosity than anything else. I just got home from a 12 hour night shift, and we'll see what I can find out later. I'll put whatever info I find in the thread. I appreciate Singularis making the thread which helped save me a bunch of money, it only feels right to provide a little more information and context to see how this is being applied.

So I looked around and so far have only found two sites that are applying the new excuse tax to orders. Those are P&C and SP.

I checked the following sites and put tobacco items in my cart, and made it to the point of submitting the order and the new tax wasn't included...The Country Squire, Boswell's, Tobacco Pipes, Cup O' Joes, L.J. Peretti, Watch City Cigar, BnB Tobacco.

Like I said before, that doesn't mean you don't owe the tax or the order information doesn't get submitted to the state department of revenue through card companies or PayPal somehow. I don't know how that works, and I'm not advocating anybody but or not buy from any company, I'm just providing information. If I end up owing tax from my Squire purchase and it's taken from my tax refund, I won't be upset.

I checked the following sites and put tobacco items in my cart, and made it to the point of submitting the order and the new tax wasn't included...The Country Squire, Boswell's, Tobacco Pipes, Cup O' Joes, L.J. Peretti, Watch City Cigar, BnB Tobacco.

Like I said before, that doesn't mean you don't owe the tax or the order information doesn't get submitted to the state department of revenue through card companies or PayPal somehow. I don't know how that works, and I'm not advocating anybody but or not buy from any company, I'm just providing information. If I end up owing tax from my Squire purchase and it's taken from my tax refund, I won't be upset.

So I looked around and so far have only found two sites that are applying the new excuse tax to orders. Those are P&C and SP.

I checked the following sites and put tobacco items in my cart, and made it to the point of submitting the order and the new tax wasn't included...The Country Squire, Boswell's, Tobacco Pipes, Cup O' Joes, L.J. Peretti, Watch City Cigar, BnB Tobacco.

Like I said before, that doesn't mean you don't owe the tax or the order information doesn't get submitted to the state department of revenue through card companies or PayPal somehow. I don't know how that works, and I'm not advocating anybody but or not buy from any company, I'm just providing information. If I end up owing tax from my Squire purchase and it's taken from my tax refund, I won't be upset.

Very interesting.

Could somebody who knows more than me (i.e. more than nothing) explain how one state can obligate a business owner in another state to impose its taxes on its residents?

If my WI magistrates say to a business owner in SC, "Psst, hey you, if our boy Scott orders from you, charge extra and send it to us," what's to stop that SC business owner from saying, "Go take a flying leap"?

Those SC citizens do not answer to the WI government, so how is any of this even meaningful?

I'm sure that I'm conceiving on this all wrong. Somebody help me out.

I put two orders in this year, both to companies that don’t collect the excise tax. These will be about it for me for a very long time as my cellar is built up to where I am okay with it. I’m planning on buying less and more locally and from members here so I’m done with screwing around with the excise tax game.

This may be helpfulVery interesting.

Could somebody who knows more than me (i.e. more than nothing) explain how one state can obligate a business owner in another state to impose its taxes on its residents?

If my WI magistrates say to a business owner in SC, "Psst, hey you, if our boy Scott orders from you, charge extra and send it to us," what's to stop that SC business owner from saying, "Go take a flying leap"?

Those SC citizens do not answer to the WI government, so how is any of this even meaningful?

I'm sure that I'm conceiving on this all wrong. Somebody help me out.

Supreme Court abolishes physical presence requirement for sales tax collection

The Supreme Court overturned its decision that required businesses to have physical presence in a state before the state could require them to collect and remit sales tax on purchases by customers within the jurisdiction.

A "big deal" decision, as interstate commerce, esp. via large online retailers, is (and of course has been) increasing

To answer your question more directly, state governments can sue retailers in other states for failing to comply with whatever their state law mandates re: taxes

Just ordered from Milan Tobacconists in Roanoke, VA -- no WI excise tax.

I just learned that Milan Tobacconists was a thing. I mean, I think I may have heard the name before, but never bothered investigating further what they even were (probably assuming they were based in Milan, Italy or something).

I rarely smoke aromatics -- for me they exist to boost pipe-PR at public functions -- but when I do smoke an aromatic ... well there's a reason that I just ordered half a pound of Milan's Sunset Rum. That particular one is a masterpiece. Remind me to bring you a sample next time we meet up.

The IRS has been notifiedJust ordered from Milan Tobacconists in Roanoke, VA -- no WI excise tax.