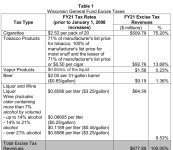

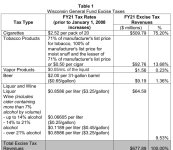

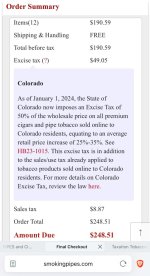

As I read it, this Wisconsin law requires out of Wisconsin retailers to collect Wisconsin excise tax (71% of the "actual cost" to the retailer, presumably the retailer's wholesale cost). Since 2018, the US Supreme Court has allowed states to require out-of-state sellers to collect sales tax for goods sold to customers in that state. Most states don't require it unless the seller sells more than a threshold amount to customers in that state. The threshold amount is up to each state and I think it's usually not less than $100,000. However, excise tax (which is "sin tax" for stuff like alcohol and tobacco) is not the same as sales tax. It's not clear to me whether states can collect excise tax from out of state sellers. Are there any tax accountants or lawyers here who know?

Last edited: