Huge Price Increase on MacBaren Tins

- Thread starter beezer

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Woods-

Woods-

A 33% overnight price hike is bad business practice, no matter how you slice it....

If it was a price increase in raw tobacco it would be understandable. But NOBODY else has raised their prices 33%....

Something Stinks here... I understand prices cannot remain static, and profits must be made.... Why just Mac B's increase??

I merely stated that maybe their business model is losing money... No need to introduce a new blend every 2 months.... Anyone smokin' the Cube these days???

If its not greed, what is it then?? A responsible company would at LEAST raise the prices incrementally....

Not True..... I said, maybe they had a change in leadership? But, yes, greed is common in the corporate world.....Beefeater, I like how you assume the worst in people.

Nor do you Sir.........You have absolutely no idea what lies behind Mac Baren's business decisions

Really?? Apples to Oranges??........ I thought they were both European tobacco blenders/producers??? Enlighten me please if I'm wrong.....Then you make an apples-oranges comparison to Germain

Woods-

A 33% overnight price hike is bad business practice, no matter how you slice it....

If it was a price increase in raw tobacco it would be understandable. But NOBODY else has raised their prices 33%....

Something Stinks here... I understand prices cannot remain static, and profits must be made.... Why just Mac B's increase??

I merely stated that maybe their business model is losing money... No need to introduce a new blend every 2 months.... Anyone smokin' the Cube these days???

If its not greed, what is it then?? A responsible company would at LEAST raise the prices incrementally....

Those Greedy Consultants....... :lol:Maybe you'll get a phone call in the morning, offering you a consulting job. Maybe

Greed is common throughout the globe and is most certainly not restricted the corporate world. Probably more altruism in the private sector than anywhere else. Attribute it to shaping corporate image if you must but, big companies donate and donate to non-profits and other charities. And greed in and of itself is not a bad thing. It can be a great motivator.

My retirement relies on the performance of the corporate world. Germain may have a business model vastly different than Mac Baren. Vastly different. Unless they have the same model and operating conditions, costs, etc., apples and oranges.

I sympathize with your anguish. But the idea that employees should be uprooted from their homes and made to move to another country in order to stay employed is much more off putting than a price increase. At what point would consider the employees over your wallet?

Wouldn't it be much easier, rather than try to figure out the situation or attempt to empathize with the company to simply and quietly stop purchasing the product if it is out of your reach or such an increase makes you indignant?

My retirement relies on the performance of the corporate world. Germain may have a business model vastly different than Mac Baren. Vastly different. Unless they have the same model and operating conditions, costs, etc., apples and oranges.

I sympathize with your anguish. But the idea that employees should be uprooted from their homes and made to move to another country in order to stay employed is much more off putting than a price increase. At what point would consider the employees over your wallet?

Wouldn't it be much easier, rather than try to figure out the situation or attempt to empathize with the company to simply and quietly stop purchasing the product if it is out of your reach or such an increase makes you indignant?

Considering the dropping euro, you'd think they'd want to increase sales in the USA, this is what's puzzling. You don't even see price increases this extreme overnight in Canada

Increasing sales is no help if the profit isn't there. Losing money on every sale is not a good idea.

Yes Warren, it would be much easier, but I've never been one to take the "Easy Road"........... :Wouldn't it be much easier, rather than try to figure out the situation or attempt to empathize with the company to simply and quietly stop purchasing the product if it is out of your reach or such an increase makes you indignant?

:

:Interestingly, I just got the P&C magazine that listed Capstan at $12ish a tin. Unfortunately, the online price is in the $16 range.

To-date I have heard nothing from Messrs. Jensen or Levine in response to my messages to them. Apparently neither checks their Private Message in-box with any regularity.

Not if the market will bear it.A 33% overnight price hike is bad business practice, no matter how you slice it.

This thread has been up and active for a couple of days now, with responses from membership ranging from histrionics to silence. What remains to be seen is the impact of the price lift on sales.

Reduced unit sales is one potential outcome of taking pricing, but so is increased revenue due to the lift. In fact, it's possible to have both when a company takes pricing. Just how much new sales revenue will be generated, and what happens to unit sales is what (I assume) Mac Baren and their supporting retailers will be watching. Something that will be demonstrated over time, by the purchasing behaviour we all demonstrate.

Peck's question about the economics of tin production is interesting. Perhaps there is a desire to push the consumer to bulk buying. Perhaps the input costs on tins, seals, paper, art, labels and production have gone up significantly. Perhaps the tin consumer is less price sensitive than the bulk tobacco consumer...

It will be interesting to see what comes next.

On "greed"... While assuming that a corporation is trying to 'stick it to the customer' whenever prices are raised is an easy thing to do. It's also, generally, an emotional reaction to increased prices that is not founded in fact. What do we really mean by "greed" in this scenario. Does it mean, "taking pricing when the company doesn't need to?" If that's the case, who has seen MacBaren's books? Can we really comment on whether this move is "gouging" or a tough decision based on sound principles?

Does it behoove a business to charge as much for their products as their customers will bear? Yes. This allows the company to return profits to all stakeholders, prove value to the market, drive share price, maintain product quality and keep their employees happy. Does this mean taking price increases in the wake of increase costs and business pressures? Yes. Does it mean risking the departure of customers to the competition? Yes. Taking pricing isn't something that companies take lightly, and it is a decision that will have ramifications on the long-term viability of their business.

It will be interesting to see how this plays out in the market.

My prediction? Look for similar lifts from other major blending companies over the next 12 months.

-- Pat

Very good observations and insights, Pat.

One other note: Life is not linear and predictable. There are surprises along the way, and often times they are not pleasant. Situations evolve and devolve, endeavors fail to reach fruition, sh*t goes on behind your back and sometimes it all just goes bad, despite best efforts.

I doubt that this price increase was planned very far in advance.

One other note: Life is not linear and predictable. There are surprises along the way, and often times they are not pleasant. Situations evolve and devolve, endeavors fail to reach fruition, sh*t goes on behind your back and sometimes it all just goes bad, despite best efforts.

I doubt that this price increase was planned very far in advance.

pruss might be on to something here. It surely looks to me that Dunhill has been releasing the newly released old blends at super premium prices or prices higher than the line in general. The blessings of conglomerate tobacco.

From a personal standpoint, I am glad I have finally built my cellared stocks to the level that I can be very picky with what I buy to replace my normal usage in both Mac Baren and Dunhill.

And as we wait in Pennsylvania to see how much if any of the governor's requested 40% tax increase it is not pleasant to think of that rate imposed on blend prices increases such as these.

From a personal standpoint, I am glad I have finally built my cellared stocks to the level that I can be very picky with what I buy to replace my normal usage in both Mac Baren and Dunhill.

And as we wait in Pennsylvania to see how much if any of the governor's requested 40% tax increase it is not pleasant to think of that rate imposed on blend prices increases such as these.

I dunno... Mac Baren has been pretty actively working to evolve their US business in the last 24 months. I have to think that there is a strong strategic plan in place. This doesn't smack as reactionary to me. Especially as it comes to growing the American base.I doubt that this price increase was planned very far in advance.

May 1, 2013 - Mac Baren buys the Altadis USA Pipe Tobacco Division and renames it Sutliff Tobacco Company

- Sutliff becomes the sole importer and distributor of Mac Baren tobaccos in the US

- Mac Baren begins importing and distributing Sutliff internationally

September, 2014 - Brigham USA and Sutliff Announce joint venture

- Brigham USA and Sutliff announce jv to combine Sales, Marketing and Distribution throughout the US

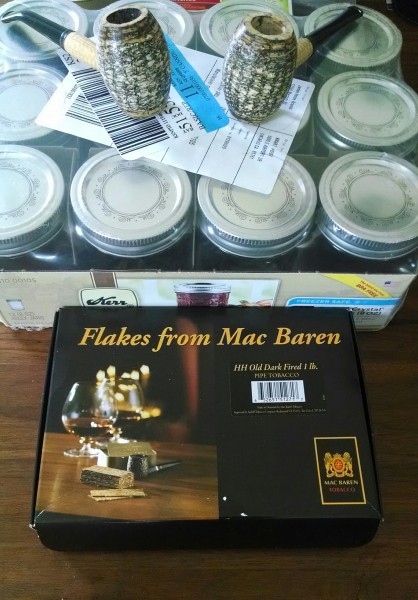

Spring, 2015 - Mac Baren launches new packaging, and new tin sizing for HH tobacco line

- Tobaccos previously only available in 100g tins are now available in 50g tins and vice verca

May 2014 - May 2015 - Mac Baren adds three new tobaccos

- May 2014, HH Latakia Flake

- October 2014, Modern Virginia

- March 2015, Bold Kentucky

$0.05 in the bucket.

-- Pat

For 100g tins $20 isn't that bad considering the 50g tins are $11.

Rattray's 100g tins are $16 at P&C.

Let's face it, MacB 100gm tins were a steal for a long time. And the bulks are still at a good price. I'll buy bulks of the MacB blends I smoke a lot (like Mixture and HH VS), and tins of the stuff I don't smoke a lot of. If it's something I haven't tried,I'll buy a 50gm tin. :

:

:I received no reply to my Private Message to Per Jensen, nor to my subsequent one to Mr. Levine, so today I sent one to Kevin asking if he would be so kind as to contact Mr. Jensen and offer him the opportunity to respond to this thread.

Kevin promptly responded as follows: "HunterTRW: Thanks for the note. I'm not going to send anything further to your messages. I'm sure that Brian has at least seen the message, and probably the thread. I happen to know that he is very busy travelling, so he might not get a chance to address it until next week. I think Per is quite busy right now as well. Please be patient. Thanks again for taking the initiative. - Kevin"

Kevin promptly responded as follows: "HunterTRW: Thanks for the note. I'm not going to send anything further to your messages. I'm sure that Brian has at least seen the message, and probably the thread. I happen to know that he is very busy travelling, so he might not get a chance to address it until next week. I think Per is quite busy right now as well. Please be patient. Thanks again for taking the initiative. - Kevin"

Private Messages are not really that I am surprised to see. Airing such, I fear will result in any answers being couched in general terms and platitudes written with an eye to such a public airing. I may be wrong but, that is how I would address the situation knowing that any reply I may make will be published. I would carefully couch any reply in terms carefully chosen so as not to expose any trade secrets or financial problems. I would be very inhibited in my reply.

Hopefully, if you receive any replies, they will remain private unless you receive tacit authorization to pass the reply or parts of it on to the membership. Perhaps I am old fashioned. For me private correspondence is just that, private. I would consider any unauthorized publication of my private correspondence as a breach of trust.

Hopefully, if you receive any replies, they will remain private unless you receive tacit authorization to pass the reply or parts of it on to the membership. Perhaps I am old fashioned. For me private correspondence is just that, private. I would consider any unauthorized publication of my private correspondence as a breach of trust.

- Status

- Not open for further replies.