The first Mormons taught that the original Garden of Eden was in Missouri, and although I’m a Christian (only) I do tend to agree with the Mormons about Missouri being the right state, only Joesph Smith was about a hundred and fifty miles too far North on pin pointing the exact spot.

en.m.wikipedia.org

In the entire civilized world, Missouri taxes cigarettes the least.

The federal tax on cigarettes is now a dollar and Missouri adds 17 cents a pack.

So the convenience stores offer Burley brand cigarettes, made in Oklahoma, at about $2.50 a pack. Marlboros are about $5 a pack.

In Missouri the tax on all other tobacco products besides cigarettes is:

—-

Other tobacco products are taxed at a rate of 10 percent of the manufacturer's invoice price before discounts and deals.

—-

The federal pipe tobacco tax is now $2.88 a pound, which is 18 cents an ounce.

There’s hardly any profit in selling tobacco at a gas station or liquor store. The manufacturers essentially pay you to sell it, by giving rebates.

The federal cigarette tobacco tax is currently $26 a pound. This was done by the huge tobacco companies by their paid hirelings in Congress in 2009, because two pounds of true cigarette tobacco will roll about 900 cigarettes, at one gram per roll your own, and that actually puts the roll your own smoker at a slight tax penalty, compared to factory cigarettes.

My son buys Gambler Gold pipe tobacco and rolls his own cigarettes using Bugler standard papers. His cost is 60 cents a pack. The tobacco is $12 a pound, the papers cost $60 for five thousand, and he buys eight pounds of Gambler to roll 5,000 cigarettes. His total cost is $180 for 5,000 cigarettes, and they are delicious.

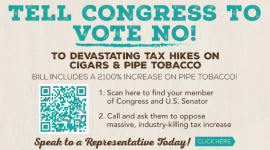

The federal tax on 5,000 cigarettes today is $250. Those huge cigarette companies, in league with do gooders against tobacco, are aiming the pipe tobacco increase at roll your own cigarette smokers.

My son might buy a pound of Gambler at a time, for maybe $75, and still roll his own.

But more likely he’ll start buying $4 a pack cheap cigarettes.

Where putting true pipe tobacco in the same tax bracket as tax beater pipe tobacco (which is what all those cheap pipe tobaccos really are) is certain to hurt us this.

I still see, and occasionally buy an ounce and a half package of value brand or Prince Albert pipe tobacco for $3.

The current federal tax on that pack is a negligible 27 cents and Missouri taxes about the same, or let’s say fifty cents.

A federal tax of nearly five dollars will raise the 10% Missouri tax to nearly a dollar because that $3 pack of real pipe tobacco will nearly have to sell for $10.

The customers will more than likely buy a couple of packs of cheap cigarettes.

Even today, those little two ounce cans of luxury pipe tobacco are $12 to $15.

It won’t hurt them nearly as bad, if they wind up $20 to $25, by percentage increase.

I’m stocking up again on value brand aromatics.

My wife puts out a big garden, even has a greenhouse.

There’s a point where a feller might be able to raise his own smokes, you know?