How long would it take you to turn $15 into $100The advise was given only to ones who want to follow it. Others can ignore.

If making $ 85 by flipping a McClelland tin makes you rich/happy go for it. People who manage their money better don’t have to get rich by flipping tobacco tins ?

Cellaring Query - What are You Cellaring Most?

- Thread starter Franco Pipenbeans

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

I am not going to explain Risk Management … but amount of risk I am willing to take … It will be 17-18 years ?How long would it take you to turn $15 into $100

I am no longer going to engage in this, unless it is an exciting math problem

There's another side of that equation. People who manage their money better can afford to buy all the tobacco they want to hedge against blends going away and for aging purposes. Purchasing to protect against imminent price increases is just one additional justification.The advise was given only to ones who want to follow it. Others can ignore.

If making $ 85 by flipping a McClelland tin makes you rich/happy go for it. People who manage their money better don’t have to get rich by flipping tobacco tins ?

Look at it this way. At $100 per pound, you could purchase 200 pounds for $20,000. Spread over 40 years that averages $500 per year. Now to your argument, $20,000 earning 3.75% compound interest for 40 years is around $81,000. Spread over 40 years that is $2,000 per year. That's still a reasonable amount to spend to insure you have what you want to smoke for the next 40 years. Here's the other side of that. 40 years from now, $80,000 won't amount to much when you factor inflation into the equation.

Here's the other thing. If the stock market crashes, your tobacco cellar won't take a hit.

It happened in a matter of minutes in early 2018. When 40th Anniversary was first released in 2017, there was a seller on ebay trying to sell them for $100/tin when it was still in stock online. Makes it even funnier knowing that most of my tobacco was bought on sale. A lot of my McClelland stuff was bought during an IPSD sale 2018 just a week before they closed, but many signs were pointing towards that so I stocked up before the feeding frenzy happened.How long would it take you to turn $15 into $100

When I find something I love I go deep, 150-200 plus tins. For example I purchased around 215 tins of Wessex Birade Campaign Dark Flake. Or over 150 Astleys no 44 or Capstan Blue Flake or Fribourg & Treyer Cut Virginia Plug, there are many more I can name but I am too lazy today,When I first started cellaring two and a half years ago I was so caught up in the excitement of the wide world of possibilities that were available. I cellared very wide and shallow on a ton of different blends, many of which I still haven’t tried. I don’t regret it because I have quite a lot of variety available, which is never a bad thing, but now I’m feeling increasing pressure to play catch up and start stockpiling the blends I truly love and don’t want to be without.

I smoke very infrequently, but sometime in the future that could change, and I’m only 32. Do I need 25 tins of something to last me 50 years, or 50 tins, or 100 tins? I’ve no clue.

Point being, I agree with the sage wisdom of others on here. If you have something you’re crazy for - buy it now and buy a shit load of it if you plan on smoking it regularly. You can sit and watch prices go up 15-20% on a lot of blends just over the course of 6 months lately.

Ensuring long term access to your go-to “I could smoke this shit all day” blends should be the chief concern for every newish pipe smoker like me whose cellar is not already bursting at the seams. I just sold a couple Dunhill’s and Peterson’s so I could buy a fat stack of Irish Flake, and it was 100% the right call.

I forgot to add that my 20-25 year cellar of pipe tobacco was only around 18,000.00. When I was smoking cigars I would by 25,000.00 worth per year. Pipe tobacco is dirt cheap compared to cigar or even a pack a day cigarette habit. Run the numbers on cigarettes ,

Last edited:

1. Aging purpose is OK. Aging is a good goal.There's another side of that equation. People who manage their money better can afford to buy all the tobacco they want to hedge against blends going away and for aging purposes. Purchasing to protect against imminent price increases is just one additional justification.

Look at it this way. At $100 per pound, you could purchase 200 pounds for $20,000. Spread over 40 years that averages $500 per year. Now to your argument, $20,000 earning 3.75% compound interest for 40 years is around $81,000. Spread over 40 years that is $2,000 per year. That's still a reasonable amount to spend to insure you have what you want to smoke for the next 40 years. Here's the other side of that. 40 years from now, $80,000 won't amount to much when you factor inflation into the equation.

Here's the other thing. If the stock market crashes, your tobacco cellar won't take a hit.

2. 3.75% compound interest is too low. Without much effort about 8% is very easy. With some effort you can get 9%-10% with an acceptable amount of risk. Beyond that, to me the risk becomes unacceptable but there are others who can generate higher returns with higher risk which is acceptable to them

3. Managing money is required to beat inflation. 8% beats inflation by a significant amount while the 3.75% you proposed also beats inflation

4. Tobacco is less liquid than negotiable financial instruments

5. If you would take an unacceptable amount of risk, then you can easily generate 30%-40% returns in the short term. There are ways to pick those investments, but to me they pose an unacceptable amount of risk

6. Many people can afford to buy a lifetime worth of tobacco. There are many who can’t. Buying a lifetime worth of tobacco without saving for a rainy day is a financial suicide. Everyone is free to do that, but they should be presented with both options so that they can take a decision which they think is right

I would argue you can't expect to average 8% over 40 years. With the risk you have to assume to achieve 8%, you'll hit some crashes that will wipe out a lot of your gains. Most of the so called financial experts say you should plan on being able to take out 3.75% of your money per year in order to not out live your retirement funds. I would take 8% in less than a heart beat were it guaranteed but there is no such thing. If you can somehow guarantee me 8% per year risk free, I'll gladly give you 2% of it for your efforts.

6. Many people can afford to buy a lifetime worth of tobacco. There are many who can’t. Buying a lifetime worth of tobacco without saving for a rainy day is a financial suicide. Everyone is free to do that, but they should be presented with both options so that they can take a decision which they think is right

100% agree!

I would argue you can't expect to average 8% over 40 years. With the risk you have to assume to achieve 8%, you'll hit some crashes that will wipe out a lot of your gains. Most of the so called financial experts say you should plan on being able to take out 3.75% of your money per year in order to not out live your retirement funds. I would take 8% in less than a heart beat were it guaranteed but there is no such thing. If you can somehow guarantee me 8% per year risk free, I'll gladly give you 2% of it for your efforts.

:max_bytes(150000):strip_icc()/3_SP500AverageReturnsandHistoricalPerformance_final-d4b374cc56f7425d8e3ac9d7950e0670.png)

S&P 500 Average Returns and Historical Performance

See the historical performance of the S&P 500 Index. Learn more about the factors that affect the S&P 500 average return.

Then why r o all the experts say 3.75%? And why don't you accept my proposal?:max_bytes(150000):strip_icc()/3_SP500AverageReturnsandHistoricalPerformance_final-d4b374cc56f7425d8e3ac9d7950e0670.png)

S&P 500 Average Returns and Historical Performance

See the historical performance of the S&P 500 Index. Learn more about the factors that affect the S&P 500 average return.www.investopedia.com

1. I will not accept your proposal because first I am not licensed to do so, and it is not worth my timeThen why r o all the experts say 3.75%? And why don't you accept my proposal?

2. I would not try to second guess a Financial Advisor, but just tell you

a. They have a fiduciary responsibility on your portfolio and therefore they use much more conservative models.

b. They also charge you 1% - 3% of your portfolio in management fees (In good or bad years regardless of how they performed) so your effective rate of return is much reduced

c. A financial advisor will not be able to anticipate your liquidity needs - and even those who can may be following a generic model, so chances are they are holding more cash than what you plan to withdraw further reducing your returns

d. I don’t know your source for that 3.75% but that may be tailored considering your age. Financial models tend to take more risks for younger customers than older ones

Around here that's like throwing down the gauntlet...The advise was given only to ones who want to follow it. Others can ignore.

Campaign Dark and Astley’s 44 are the only two Va’s that I truly love. I only have a few tins of each. I’d be lying if I said I wasn’t mildly aroused by your prodigious stash of these beauties ?When I find something I love I go deep, 150-200 plus tins. For example I purchased around 215 tins of Wessex Birade Campaign Dark Flake. Or over 150 Astleys no 44 or Capstan Blue Flake or Fribourg & Treyer Cut Virginia Plug, there are many more I can name but I am too lazy today,

I forgot to add that my 20-25 year cellar of pipe tobacco was only around 18,000.00. When I was smoking cigars I would by 25,000.00 worth per year. Pipe tobacco is dirt cheap compared to cigar or even a pack a day cigarette habit. Run the numbers on cigarettes ,

A week with EsotericaHow long would it take you to turn $15 into $100

2% would be worth your time but I understand I'm 64 but not yet tapping into retirement funds or SS. The majority of my funds are managed by Frontier, I've chosen a fairly conservative, low risk strategy. Were I 40 years old, I'd take a significantly more aggressive approach.1. I will not accept your proposal because first I am not licensed to do so, and it is not worth my time

2. I would not try to second guess a Financial Advisor, but just tell you

a. They have a fiduciary responsibility on your portfolio and therefore they use much more conservative models.

b. They also charge you 1% - 3% of your portfolio in management fees (In good or bad years regardless of how they performed) so your effective rate of return is much reduced

c. A financial advisor will not be able to anticipate your liquidity needs - and even those who can may be following a generic model, so chances are they are holding more cash than what you plan to withdraw further reducing your returns

d. I don’t know your source for that 3.75% but that may be tailored considering your age. Financial models tend to take more risks for younger customers than older ones

I'm not questioning your investing acumen, I'm guessing you're very competent. But we haven't had a recession in almost 14 years. That has me a bit timid. My strategy now is as much to guard against a large loss as it is to maximize returns.

One day I was in the local shop pretty much just shooting the breeze and asked about those new blue tins. I said left me try one. The owner said buy 11 one to smoke and the others to save. Wonder if he was a licensed financial advisor? Anyone that wants 10 perfect unopened tins of 40th make an off.

When I read this, I had too much to say, which would require a lot of research and lot of hard work to respond. New York Times came up with a winner though ? Fantastic advice - Even if you only read this literally, and even better if you can read between the lines.2% would be worth your time but I understand I'm 64 but not yet tapping into retirement funds or SS. The majority of my funds are managed by Frontier, I've chosen a fairly conservative, low risk strategy. Were I 40 years old, I'd take a significantly more aggressive approach.

I'm not questioning your investing acumen, I'm guessing you're very competent. But we haven't had a recession in almost 14 years. That has me a bit timid. My strategy now is as much to guard against a large loss as it is to maximize returns.

How Much Stock Is Too Much in Retirement? - https://www.nytimes.com/2022/01/21/business/retirement-stocks-vanguard.html?referringSource=articleShare

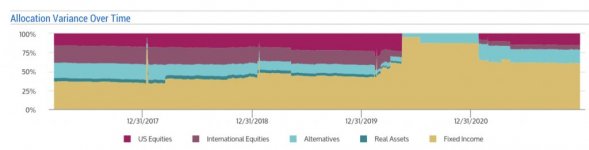

Thanks for the article. Below is the allocation graph for one of my funds. I believe you can see it is quite conservative.When I read this, I had too much to say, which would require a lot of research and lot of hard work to respond. New York Times came up with a winner though ? Fantastic advice - Even if you only read this literally, and even better if you can read between the lines.

How Much Stock Is Too Much in Retirement? - https://www.nytimes.com/2022/01/21/business/retirement-stocks-vanguard.html?referringSource=articleShare

It's an interesting idea, but if you delay purchasing any tobacco for the 25 to 40 years you're making contributions to your investment fund, you're going to miss a lot of opportunities that you won't get again at any price. But then again, you probably won't become a smoker, so there's that.3. Mathematically / Financially it does not make sense to buy tobacco because they are cheaper now. Yes they will become more costly, but money well invested in a portfolio will outperform the price rise in tobacco. So smarter thing is to invest the money in the market now, and buy tobacco at a higher price later and still have change left from the appreciation of your original investment by virtue of compounding