I was just made aware of a Wisconsin Sales Tax on tobacco products to go into effect starting Jan. 1, 2025. It sounds like a 71% levy on the final sale price of any pipe tobacco purchased from online retailers thst aren’t based in Wisconsin. Was anyone else aware of this?

docs.legis.wisconsin.gov

docs.legis.wisconsin.gov

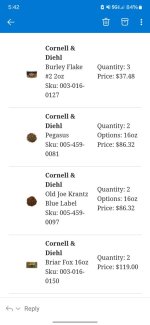

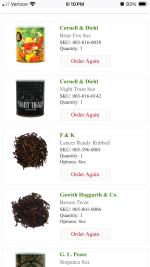

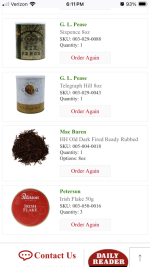

I’ll admit that I had difficulty deciphering the bill, but reliable sources say that it means an additional 71% is tacked onto the list/sale price of pipe tobacco (but weirdly no more than an additional 50¢ per cigar). That means if your bulk tobacco is $5 an ounce, the retailer must charge you essentially $8.50 an ounce. Or a tin of GL Pease on sale for $10.88 at SPC will now be $18.50.

I know other states have regulations like this. Am I reading this one correctly? Anyone else from Wisconsin know the skinny on this new law?

Wisconsin Legislature: 2023 Wisconsin Act 150

I’ll admit that I had difficulty deciphering the bill, but reliable sources say that it means an additional 71% is tacked onto the list/sale price of pipe tobacco (but weirdly no more than an additional 50¢ per cigar). That means if your bulk tobacco is $5 an ounce, the retailer must charge you essentially $8.50 an ounce. Or a tin of GL Pease on sale for $10.88 at SPC will now be $18.50.

I know other states have regulations like this. Am I reading this one correctly? Anyone else from Wisconsin know the skinny on this new law?