I’m liking this trash talk. This is like the pipe smokers version of selling a UFC or boxing match. I’d buy the PPV.I like that idea. Tim has about a much of a chance of out slow smoking me as I have of working for free.

Three Strikes And You Are Out

- Thread starter Pipeoff

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

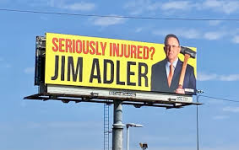

I think it’s kinda funny that you guys blame the insurance companies and not the attorneys who are suing the shit out of them at every opportunity. Premium rates are through the roof and companies are trigger happy to cancel policies; yes. However, all of this shit is a result of attorneys trying to get their hands in the money, too, and the greed driven decisions of the average human who gets in a minor bump up and feels entitled to millions. Thank you hot coffee.

This is exactly the problem. I know someone (my son) who was in a minor accident that was his fault. Straight up. His fault. The guy that was driving the other vehicle was slightly injured. His total bills for the injury was right at $25,000. This included an ER visit, chiropractic clinic, spinal surgery referral, rehab.I think it’s kinda funny that you guys blame the insurance companies and not the attorneys who are suing the shit out of them at every opportunity. Premium rates are through the roof and companies are trigger happy to cancel policies; yes. However, all of this shit is a result of attorneys trying to get their hands in the money, too, and the greed driven decisions of the average human who gets in a minor bump up and feels entitled to millions. Thank you hot coffee.

Here’s the punch line. The injured party sued the insurance company for $2.5 million. Because that’s what the car insurance and umbrella were valued at.

The insurance settled for much, much less.

Oh the grievous injury that required a chiropractic intervention (scam operation) and spinal surgeon consult (grift mill) was a sprained thumb.

But go ahead, by all means, shit on insurance companies.

Trash talk is healthy. I absolutely respect Jesse, so the trash talk isn’t personal, although he loves Barlings.I’m liking this trash talk. This is like the pipe smokers version of selling a UFC or boxing match. I’d buy the PPV.

I strongly suggest you file 2 complaints with your state insurance commission, one for the non-payment of claim, and the second for the non-renewal/cancellation of your policy. It won't cost you anything and the state will make sure the company is operating within the law. Be as concise and specific in your letter as possible, and attach any important documentation. You can probably file it online.The original company rejected my claim and refused to renew policy required by bank mortgage.

Last edited:

Are you referencing the McDonald's coffee case as your poster child for frivolous lawsuits? The case of a 79 year old woman who spent 8 days in the hospital for third degree burns to her groin, underwent skin grafting, received two further years of medical treatment, and tried to settle with McDonald's not for millions but $20,000 to cover her medical expenses? After McDonald's refused to settle a jury eventually awarded her $2.7 million in punitive damages, the equivalent of two days of coffee sales, but the judge reduced it to nearly 1/6 of that amount and she later settled for almost certainly less than that. You're saying this case, which cost a McDonald's insurer less than 4 hours worth of coffee sales, is the reason insurance companies charge through the nose and refuse claims left and right?I think it’s kinda funny that you guys blame the insurance companies and not the attorneys who are suing the shit out of them at every opportunity. Premium rates are through the roof and companies are trigger happy to cancel policies; yes. However, all of this shit is a result of attorneys trying to get their hands in the money, too, and the greed driven decisions of the average human who gets in a minor bump up and feels entitled to millions. Thank you hot coffee.

Even dismissing that case entirely, personal injury lawyers work on a contingency fee basis, meaning they only get paid if a judge or jury believes their claims have merit and sides with their clients. I suspect that some frivolous lawsuits against insurers do occur, but it would be financial suicide for attorneys en masse to base their income on that as a model. If insurance companies are seeing their bottom lines skyrocket due to lawsuits it suggests that judges/juries consistently find insurers responsible for payment in those cases.

Which do you think is more likely: that all those judges and juries are idiots and that's why struggling insurance companies have to charge so much, or that insurance companies want you to think that because it makes someone else the bad guy?

Are you referencing the McDonald's coffee case as your poster child for frivolous lawsuits? The case of a 79 year old woman who spent 8 days in the hospital for third degree burns to her groin, underwent skin grafting, received two further years of medical treatment, and tried to settle with McDonald's not for millions but $20,000 to cover her medical expenses? After McDonald's refused to settle a jury eventually awarded her $2.7 million in punitive damages, the equivalent of two days of coffee sales, but the judge reduced it to nearly 1/6 of that amount and she later settled for almost certainly less than that. You're saying this case, which cost a McDonald's insurer less than 4 hours worth of coffee sales, is the reason insurance companies charge through the nose and refuse claims left and right?

Even dismissing that case entirely, personal injury lawyers work on a contingency fee basis, meaning they only get paid if a judge or jury believes their claims have merit and sides with their clients. I suspect that some frivolous lawsuits against insurers do occur, but it would be financial suicide for attorneys en masse to base their income on that as a model. If insurance companies are seeing their bottom lines skyrocket due to lawsuits it suggests that judges/juries consistently find insurers responsible for payment in those cases.

Which do you think is more likely: that all those judges and juries are idiots and that's why struggling insurance companies have to charge so much, or that insurance companies want you to think that because it makes someone else the bad guy?

I think you’re a lunatic if you think they all go to trial. I also think that the coffee incident is what started all of this stuff. You just went to bat for a woman who felt like McDonald’s was at fault for her accident. Everyone knows coffee is hot, try not spilling it on yourself. How is dumping coffee in your own lap someone else’s fault? I stubbed my toe the other day, maybe I should file suit against the furniture company that made the couch. It sounds silly, but I assure you I can call a personal injury lawyer who’d take the case.

I’ve been in a wreck and had seven different letters from attorneys within a week of it happening. Radio and television ads ad nauseam. They’re grimy and they know they can get settlements out of court, driving up the premium for the average consumer. Premiums are risk based and formula driven; as the cost of claims get higher (thanks to lawyers), the cost of premium goes up. It’s not even something you can argue.

Your comment is spoken like an attorney. Who else would defend personal injury attorneys? This is all starting to check out. Still salty over the democracy comment?

Free rent is indeed fun, however.

It's not about working for free. That's total bullshit. It's about putting the money coming in to actual use, not just getting sucked up by management.

One area where it works? Try healthcare. We have a non profit industry healthcare and pension plan, both created over a century ago and both still going strong, in good financial shape, and providing more of its income to actual healthcare and actual pension than for profit's executive salaries and outside "investors".

For profit insurance companies now siphon off 34% for "overhead". Medicare siphons off, as of 2021, 1.3% for overhead. The rest goes to actual care. Who's betting the better deal here?

This blind and brainless belief that "private good" and "government bad" as a stupid a mantra as its opposite. Reality is much more nuanced.

Maybe that worked for you, Jesse, but my employer-union pension was so badly managed that I’ll receive perhaps 25% of what is owed.

Last year, my 24 year old home, was one of three houses in my cul-de-sac, all built within one year of each other, that sustained ice damage on the roof.

Erie - replaced my neighbors roof

Allstate - my insurer (for 42 years) - offered me a $379 payment. I declined, and replaced the roof for $15k. To that point, I had zero home claims in 42 years.

I switched to Erie, saved about $1200 on our combined auto/home policies.

Wish me luck.

Erie - replaced my neighbors roof

Allstate - my insurer (for 42 years) - offered me a $379 payment. I declined, and replaced the roof for $15k. To that point, I had zero home claims in 42 years.

I switched to Erie, saved about $1200 on our combined auto/home policies.

Wish me luck.

Apparently the it wasn't "Mayhem like me" exception! Not a laughing matter, but the ads came to mind!Last year, my 24 year old home, was one of three houses in my cul-de-sac, all built within one year of each other, that sustained ice damage on the roof.

Erie - replaced my neighbors roof

Allstate - my insurer (for 42 years) - offered me a $379 payment. I declined, and replaced the roof for $15k. To that point, I had zero home claims in 42 years.

I switched to Erie, saved about $1200 on our combined auto/home policies.

Wish me luck.

In Montana we have a law (well supported by case law and precedent) that allows for an additional cause of action for bad faith against insurance carriers. If liability is reasonably clear, they have an obligation to pay. Failure to timely do so opens them up to the additional claim and the potential damages including punitive penalties plus attorney fees and expenses. The juries freaking hate insurance companies and the potential recovery from the bad faith claim often dwarfs the original injury / tort claim which carries none of the additional awards (punitive, fees & expenses). If the jury thinks the carrier was stonewalling in the face of clear liability they will hand the insurance company their ass on a plate, charge them for the plate, the table service, the kitchen fee, and a healthy gratuity for the server. Plus the original claim recovery they should have paid in the first place.

I’ve had claim settlement discussions with large corporate adjusters from out of state carriers who were being dicks and my favorite tactic was to quietly mention that they might want to have their legal department do some quick research on the statutes and a couple controlling cases (since they obviously aren’t well acquainted with our laws and aren’t from around here - with a wide smile showing lots of teeth) and get back to me. I give them about 48 hours to pay the claim in full before filing the new additional bad faith claim. It usually takes far less than 48 hours. They aren’t used to such laws anywhere else (not sure anywhere else has them?)

I once had an attorney on the phone and he wasn’t buying it at all or even listening to me. I offered him the professional courtesy of sending him my draft complaint for bad faith, camera ready and set to file electronically with the push of a button. Told him he could review it and the citations to controlling law at his leisure since he’d be seeing it in a couple of days anyway when it would be served on his client. He snorted and said quite dismissively to go right ahead. I did. A few hours later the company settled in full, LOL. Didn’t take 48 hours at all. I’m sure they hate Montana.

I’ve had claim settlement discussions with large corporate adjusters from out of state carriers who were being dicks and my favorite tactic was to quietly mention that they might want to have their legal department do some quick research on the statutes and a couple controlling cases (since they obviously aren’t well acquainted with our laws and aren’t from around here - with a wide smile showing lots of teeth) and get back to me. I give them about 48 hours to pay the claim in full before filing the new additional bad faith claim. It usually takes far less than 48 hours. They aren’t used to such laws anywhere else (not sure anywhere else has them?)

I once had an attorney on the phone and he wasn’t buying it at all or even listening to me. I offered him the professional courtesy of sending him my draft complaint for bad faith, camera ready and set to file electronically with the push of a button. Told him he could review it and the citations to controlling law at his leisure since he’d be seeing it in a couple of days anyway when it would be served on his client. He snorted and said quite dismissively to go right ahead. I did. A few hours later the company settled in full, LOL. Didn’t take 48 hours at all. I’m sure they hate Montana.

To add insult to injury, the rep at my local office (where I've been for 42 years), had the audacity to tell me that it was my fault rates are so high due to home owners trying to take advantage of the insurance companies. I reamed her and the owner out, and switched companies a week later.Apparently the it wasn't "Mayhem like me" exception! Not a laughing matter, but the ads came to mind!

Sadly I think we’re on the brink of a major change to our society caused by property insurance. It’s inevitable that some of the hottest real estate markets in the country will get a gut punch when there’s no available home owner coverage available anymore. Coastal, floodplain, wildfire, hail, tornado, etc. prone areas will probably not be able to get policies underwritten and that’s going to cause chaos and major disruption. What exactly can one do with a million dollar home when nobody will insure it??! Can’t sell it, can’t buy it, can’t afford to live in it without coverage - just wait for it to burn/flood/blow away??? Lose your equity? Complain to Congress??

I’m afraid we all have some pain coming and the insurance industry is leading the charge straight into it.

Ugh

I’m afraid we all have some pain coming and the insurance industry is leading the charge straight into it.

Ugh