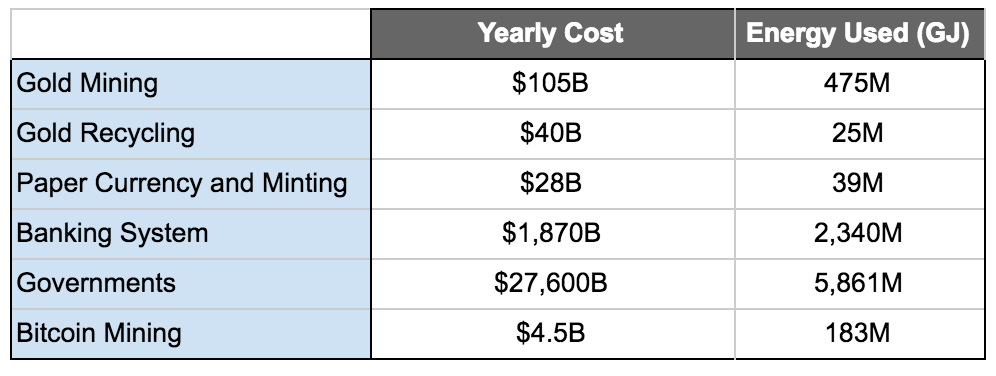

Mining via large expenditures of energy is going to die out sooner than later. These days if you're doing something new, just avoiding it in the first place is better than trying to invent ways to keep doing it. Using energy-expenditure as an excuse to build cash value on any of this stuff never resonated with me. Other solutions are already out there & will continue to be developed. But, I think BTC & the other upstarts had to do it in order to prove themselves. Will BTC continue legacy mining? Probably for now, what choice does it have? But other ways will be utilized to secure other chains & probably will move away even from merge-mining. Look at ETH, moving from POW to proof of stake soon. A lot of chains in the interim have been merge-mined on top of existing POW chains, costing very little additional energy to generate those new merge-mined chains. Use-cases & values of these things will be determined by data/ network security, tx fees, speed, scalability, adoption, & many other things. But it looks like the energy-intensive stuff is getting hit hard in the markets right now, not carried. I think it's a little over-blown due to certain tweets, but the energy-usage has been a known issue & something to minimize or avoid with newer stuff, & some of the more "eco-friendly" networks & chains have been getting a boost in cash value over the past few days because of that attribute, & the tweets. P.S. - I still like BTC too.