A global government can do that. And more.A government would need to shut down the entirety of the internet

Any Crypto Investors (Gamblers)?

- Thread starter Worknman

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ah

Ah, purchase it. If it has real intrinsic value, embrace the price.If Bitcoin is so easy to obtain please make some and send it to all of us!

A global government can do that. And more.

And an asteroid can wipe out all of life on earth. These "what if" scenarios are incredibly silly. How would a global government function with the internet? You realize everything today requires the internet and it would be a zero sum game for anyone to shut it down.

Are there uncertainties regarding Bitcoin and governments in the future? Perhaps. I would argue the risks are incredibly small as countries such as China have already attempted to ban Bitcoin, it totally failed, and Bitcoin has grown exponentially since then. I think it is far more likely that eventually central banks will be forced to purchase Bitcoin, with the first mover having a significant advantage. However what I do know, beyond any shadow of a doubt, is that the fiat I have, and you have, will continue to be inflated to literally nothingness. That is 100% guaranteed.

Ah

Ah, purchase it. If it has real intrinsic value, embrace the price.

I have been embracing the price buying at $7,000, $10,000, $15,000, $35,000, $50,000. You get the idea. I believe my highest price paid was around the $54,000 mark.

That's WHY the Internet is in the process of being taken over by governments. So-called anti-hate-speech protections, geographic-based-available-only content, government's police agencies opening a file on anyone downloading the Tor browser, the taxmen browsing these forums as lurkers trying to find out who's getting tobacco into a country without paying duties... the list goes on and on. It was only a matter of time before the whole Internet became regulated.And an asteroid can wipe out all of life on earth. These "what if" scenarios are incredibly silly. How would a global government function with the internet? You realize everything today requires the internet and it would be a zero sum game for anyone to shut it down.

And how the heck do I know that Bitcoin itself isn't a tool of the PTB? Aren't transactions tracked?

There are KYC regulations to purchase Bitcoin on exchanges just as if you were to buy stock from a brokerage. Once the Bitcoin is moved off the exchange it is incredibly difficult to prove it is yours, particularly when using coin mixing services such as coin joins or whirlpool. However it is possible to buy Bitcoin P2P, bypassing KYC.That's WHY the Internet is in the process of being taken over by governments. So-called anti-hate-speech protections, geographic-based-available-only content, government's police agencies opening a file on anyone downloading the Tor browser, the taxmen browsing these forums as lurkers trying to find out who's getting tobacco into a country without paying duties... the list goes on and on. It was only a matter of time before the whole Internet became regulated.

And how the heck do I know that Bitcoin itself isn't a tool of the PTB? Aren't transactions tracked?

The regulations just show that Bitcoin is legitimate in the eyes of the government. It has been deemed an asset, and taxed as such. As long as the tax man gets their cut they are happy. Bitcoin ETFs were just approved in Canada, and Fidelity (as well as several others) are working to having one approved here in the United States. Congressmen and women are buying Bitcoin. Ever heard of Black Rock? You know the one with nearly $9 trillion AUM? They now offer Bitcoin futures. JPMorgan, BNY Mellon, Morgan Stanley - all now getting into crypto one way or the other. In January the OCC approved the first national bank charter for a digital bank. The world is adopting Bitcoin. Better join now, rather than later, or worse, never.

History. I guess only losers pay any attention to that subject. Hey, get with it people. What's real is now and relevance is what is happening now.

How much bitcoin do you need to fill up your gas tank in Florida?

How much bitcoin do you need to fill up your gas tank in Florida?

History. I guess only losers pay any attention to that subject. Hey, get with it people. What's real is now and relevance is what is happening now.

How much bitcoin do you need to fill up your gas tank in Florida?

History is something I deeply love and I study everyday simply for fun so I am not sure where you’re going with that.

As for how much Bitcoin it would take to fill your tank, that depends how big your tank is. Although you clearly haven’t read what I have written. I stated multiple times Bitcoin is an asset not a currency. Do you buy gas with gold or with land?

And for a little ‘history’ perhaps you should read about how in ancient Judaea some would fix their scales when measuring gold in order to steal from the other party. This was before there was standardized coinage. Or about how some would shave pieces of gold off their coins and collect them until they artificially created another coin. Or how the Roman Empire debased their currency to worthless pot metal. Or about the Weimar Republic. History is quite clear about what happens when society abandons sound money.

The real rabbit hole in all of this is the blockchain...how it functions, and all of it's potential Orwellian applications.Aren't transactions tracked?

And to say the "mining" process is bizarre is an understatement (energy issues aside). That is why I commented about the Raida alternative earlier in the thread...not because I anticipate that it will ever really go anywhere (although who knows?) but because it makes so much more sense to me than the blockchain.

Real estate may be good for now but there will come the day when Bitcoin sucks the monetary premium out of it as well as all of these other false stores of value. A house didn't use to be thought of as a store of value, at least not how we think of in now. It was utilitarian. You lived in the house. It wasn't used to prevent your money from losing value. That is what a savings account was for. Now people lose money when they have a savings account so they buy real estate as well as stocks to hedge against inflation, adding monetary premiums to them respectively. Stocks used to be speculative, they certainly still are, but people now buy stocks as a form of savings account.Bitcoin is, of course, interesting, but I think it is dangerous to invest money there. I am choosing real estate. Recently I bought an apartment by the sea and now it can be rented out, making a profit, or you can have a rest yourself.

View attachment 79865

Bitcoin is the replacement of the savings account.

People have purchased real estate for decades as investments, either to flip or to rent as passive income. That's an odd statement to say otherwise because it's not true. Flipping may be more of a recent trend over the past 20 years, but owning to rent has been around a long time. My parents did it 50 years ago and then sold the house at 100% profit like 40 years ago.

I'll never touch something like bitcoin, but I also live a simpler life with little care for such things.

I'll never touch something like bitcoin, but I also live a simpler life with little care for such things.

People have purchased real estate for decades as investments, either to flip or to rent as passive income. That's an odd statement to say otherwise because it's not true. Flipping may be more of a recent trend over the past 20 years, but owning to rent has been around a long time. My parents did it 50 years ago and then sold the house at 100% profit like 40 years ago.

I'll never touch something like bitcoin, but I also live a simpler life with little care for such things.

Owning to rent yes but I am saying many buy real estate on the assumption that the value will continue to increase at higher rate than inflation thus preserving value. With COVID and the money printing we saw stocks, real estate, Bitcoin all go up. A major reason for this is people looking for stores of value against run away inflation. What I am getting at is that Bitcoin will absorb the monetary premiums from both stocks and real estate as it is engineered to be a store of value while stocks and real estate are not.

As for Bitcoin and simplicity of life. Many who buy Bitcoin live simpler lives because they have low time preference and defer buying things now to instead buy Bitcoin. As I said it is a savings account. People who save a lot generally live simpler lives!

lol @modsBitcoin is, of course, interesting, but I think it is dangerous to invest money there. I am choosing real estate. Recently I bought an apartment by the sea and now it can be rented out, making a profit, or you can have a rest yourself.

View attachment 79865

Yup I just joined the game too! I like gambling, and I don't even have to leave the house! It's funI recently splurged a little on bitcoin, ethereum and cardano (thanks stimi), but with these new insane capital gains tax proposals Im a little hesitant.

On a side note I bought my first bitcoin back in 2013 for $27. Unfortunately I wasn't smart enough to hold it long enough to reap the rewards of the current $58,000 price...?

The recent housing problem isn't cause by people parking money in real estate to protect against inflation. It's due to a number of things causing a domino effect.

COVID caused people to want to get out of high density areas so they started looking to build or purchase homes outside of their denser cities. COVID shut down raw material manufacturers at the same time interest in home building started to increase. Materials went way up in demand while raw material production went way down. Next the interest rates dropped, causing even more of a rush for people to buy/build houses. As raw materials became hard to buy or more expensive, a larger percentage of the "build new" crowd shifted to "buy old" which crowded the "buy old" market even more than it already was as they are now fighting with the typical new home builder.

This has nothing to do with bitcoin or money printing. It's just a year long cause/effect scenario of one thing impacting the next. Everyone who buys a home, especially a second home, has done it at least in part because it should retain value at a minimum. No one buys a home thinking, yep, I'm going to lose 10% on this purchase and that's just what I'm looking for.

Everyone's definition of simpler is different. I'm more concerned with what's going on outside my front door or how my neighbors are doing and less with a global market. Holding no debt is of more interest to me than dividends and returns.

COVID caused people to want to get out of high density areas so they started looking to build or purchase homes outside of their denser cities. COVID shut down raw material manufacturers at the same time interest in home building started to increase. Materials went way up in demand while raw material production went way down. Next the interest rates dropped, causing even more of a rush for people to buy/build houses. As raw materials became hard to buy or more expensive, a larger percentage of the "build new" crowd shifted to "buy old" which crowded the "buy old" market even more than it already was as they are now fighting with the typical new home builder.

This has nothing to do with bitcoin or money printing. It's just a year long cause/effect scenario of one thing impacting the next. Everyone who buys a home, especially a second home, has done it at least in part because it should retain value at a minimum. No one buys a home thinking, yep, I'm going to lose 10% on this purchase and that's just what I'm looking for.

Everyone's definition of simpler is different. I'm more concerned with what's going on outside my front door or how my neighbors are doing and less with a global market. Holding no debt is of more interest to me than dividends and returns.

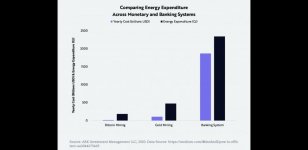

A more accurate chart should further break it down to amount per user and amount per transaction expenditures instead of a lump sum comparison. Doing a single, industry comparison is like comparing pipes to cigars to cigarettes without acknowledging the drastic size of scale differences between them all.

It's essentially an elaborate Pyramid scheme. It came from nothing. It's backed by nothing. It's not a currency in any legitimate sense, no matter how many hucksters promote it as one. It's nothing that can't be replicated a bunch of times, and there are new versions starting up with "investment advisors" touting the opportunity to get in early. Elon Musk is playing games with it, which shows just how weak it is when one person can drive a 30% drop. It can be stopped very easily by not being convertible back into "fiat" money. Bitcoin is essentially shitcoin, the 21st century tulip.I have been embracing the price buying at $7,000, $10,000, $15,000, $35,000, $50,000. You get the idea. I believe my highest price paid was around the $54,000 mark.