Pensions are slowly disappearing. Companies will be redirecting responsibility to the employ to fund their own retirement w/whatever matching contributions they agree to provide. A large percentage of these funds will be invested into the market. Good or bad, that’s the trend, particularly for those starting their careers.

Record Dow Jones Over 37,000

- Thread starter Briar Lee

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

Most people are living paycheck to paycheck and are unable to invest without suffering some intense loss. I was lucky enough to have parents who invested as well as my own investments when I worked. I still own stock in Walgreens from matching contributions.

Most of my friends have been unable to invest due to cost of living increases not matching pay. When we were in our teens I told them to use the rule of thirds: 1/3 cash, 1/3 savings, 1/3 investments. I have a nice nest egg to live on until my disability gets approved (they are ridiculously backlogged) that I can live comfortably.

Most of my friends have been unable to invest due to cost of living increases not matching pay. When we were in our teens I told them to use the rule of thirds: 1/3 cash, 1/3 savings, 1/3 investments. I have a nice nest egg to live on until my disability gets approved (they are ridiculously backlogged) that I can live comfortably.

Only ranked at 10th strongest currency in the world, 1st being the Kuwaiti dinar.

Wikipedia

As of 2022, Kuwait has a population of 4.45 million people of which 1.45 million are Kuwaiti citizens while the remaining 3.00 million are foreign nationalsfrom over 100 countries.

Xxxxx

More than a million Americans have died with Covid on their death certificates since the Dow plunged by nearly half in the spring of 2020.

And there’s still about 335 million of us left.

We all need groceries. Of you look around we ain’t very many of us too skinny.

The wealth of the United States as a whole is almost beyond calculation.

There’s over 35 trillion held in Dow Jones stocks alone yesterday.

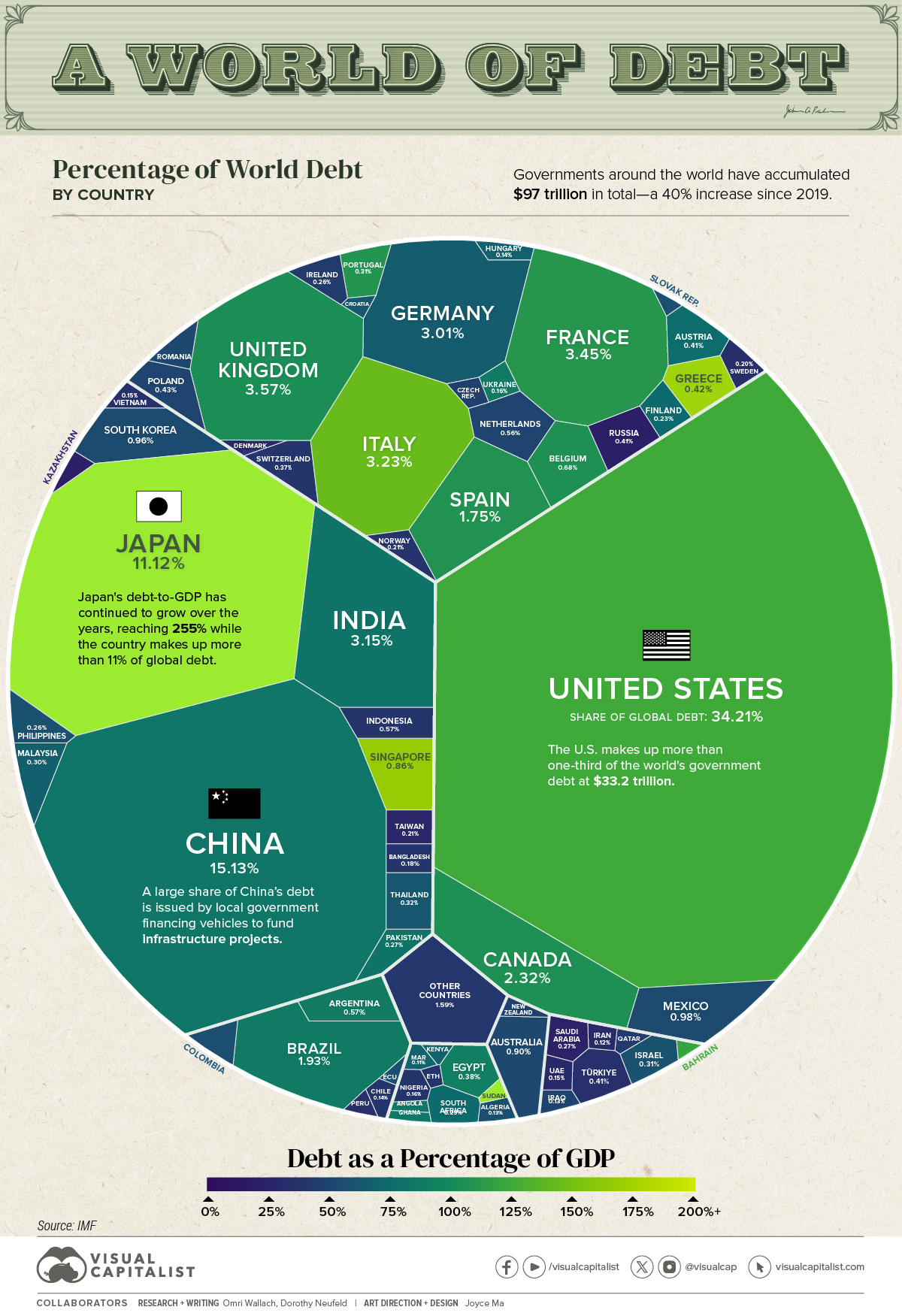

Our national debt is actually an asset in our portfolios, United States treasury obligations, and Americans own 80% of it and Japan owns a trillion and China a little less than a trillion.

The actual assets of the USA may be one thousand trillion dollars.

All of our debt together is a small fraction of that.

Yesterday the Senate passed the largest defense budget in history, three times the annual GDP of Kuwait, and that 850+ billion is only 3 per cent of our 26 trillion dollar annual GDP.

We have 11 super carriers in commission and are building three more.

Britain has two great big carriers, and they use our planes.

It’s just hard to add it all up.

Which is why folks take our dollars, you know?

Nope. It has been foisted on them and used as a weapon.The same as gold used to be.

People all over the world have decided it is the ultimate money token.

From the Bretton Woods agreement, and subsequently manipulated via tied to oil sales.

Gold has inherent value, paper from a bankrupt nation does not.

BRICS is gaining momentum and the $ may soon take a tumble.

Gold is the ultimate "money token", as that's what banks purchase and hoard.

Nope. It has been foisted on them and used as a weapon.

From the Bretton Woods agreement, and subsequently manipulated via tied to oil sales.

Gold has inherent value, paper from a bankrupt nation does not.

BRICS is gaining momentum and the $ may soon take a tumble.

Gold is the ultimate "money token", as that's what banks purchase and hoard.

The stock market is all well and good, but if you'd invested all your money into tins of Balkan Sobranie in 1950 you would now be richer than Musk & Bezos combined!

It's none of my business, but when I hear things like this it makes me wonder what your plans on for retirement (if you plan to retire)? Based on your user name, I might infer you are a fireman and if so you likely have a pension. If you have a pension, you've likely contributed to the markets indirectly through payroll deductions unless your employer covers 100%.I keep well out of the market. I have never put in a single penny in.

I love when one of these "economic" threads pop up. They are entertaining. the usual gang of players can be counted upon to replay their standard repertoire. Lots of trees, not much forest.

Lees professor's lesson is essentially correct. Long term steady investment in markets results in a tidy nest egg at retirement. Period.

"Markets are fixed" Sure they are, and always have been through human history. That's part of human nature, looking for an advantage, best of all an unearned one. But for a scam to work long term it needs to spread the wealth enough to keep the customers returning. So insiders make a pot load and outsiders who are disciplined do well over time. The the customers, who make the insiders very, very wealthy, keep coming back.

"Gold has inherent worth." Baloney. Gold has no more "inherent" worth than anything else. Its just atoms. But belief and physical attraction have brought about a decision to make it valuable, same with silver, same with platinum, etc, etc. Of course, staying tied to a limited supply standard would have put severe restraints on capital growth, so it had to go, and we have the paper economy, which works by agreement that screwing with it too much will not go well. Easier to tweak than a gold based economy, with less depressions, panics, etc, just steady erosion of buying power to take care of pesky things like raises. And it's easier to print more and more of it.

"Housing bubble" Sorta. Problem is that over the past 40 years, governments, Federal, State, and Local, have been ignoring warnings of housing shortages and what building has been done is a fraction of what needed to be done. Add to that the "free money"mortgage rates of the 12 years following the 2008 Great Recession, and there not much stock available on the market. Supply and demand. There not enough supply, so this "bubble" has a long way to go before it pops, if it pops.

In any event, stock and real estate, actual real stuff, is where you have a possibility of growing some wealth if you're not the entrepreneurial type.

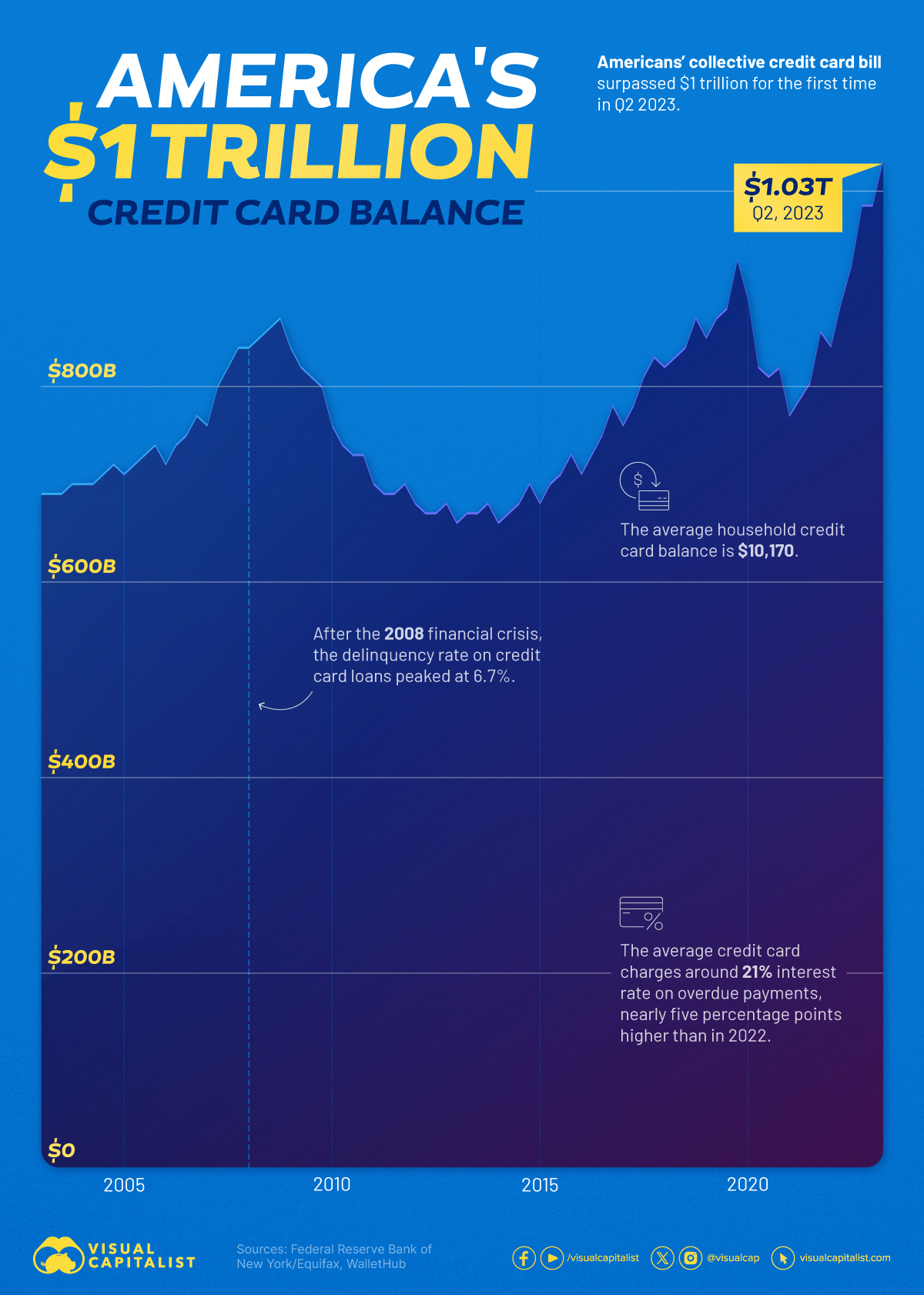

The big crisis the average amount of savings in my age group isn't enough to cover basic costs like food and shelter, much less medical care. They are screwed.

Lees professor's lesson is essentially correct. Long term steady investment in markets results in a tidy nest egg at retirement. Period.

"Markets are fixed" Sure they are, and always have been through human history. That's part of human nature, looking for an advantage, best of all an unearned one. But for a scam to work long term it needs to spread the wealth enough to keep the customers returning. So insiders make a pot load and outsiders who are disciplined do well over time. The the customers, who make the insiders very, very wealthy, keep coming back.

"Gold has inherent worth." Baloney. Gold has no more "inherent" worth than anything else. Its just atoms. But belief and physical attraction have brought about a decision to make it valuable, same with silver, same with platinum, etc, etc. Of course, staying tied to a limited supply standard would have put severe restraints on capital growth, so it had to go, and we have the paper economy, which works by agreement that screwing with it too much will not go well. Easier to tweak than a gold based economy, with less depressions, panics, etc, just steady erosion of buying power to take care of pesky things like raises. And it's easier to print more and more of it.

"Housing bubble" Sorta. Problem is that over the past 40 years, governments, Federal, State, and Local, have been ignoring warnings of housing shortages and what building has been done is a fraction of what needed to be done. Add to that the "free money"mortgage rates of the 12 years following the 2008 Great Recession, and there not much stock available on the market. Supply and demand. There not enough supply, so this "bubble" has a long way to go before it pops, if it pops.

In any event, stock and real estate, actual real stuff, is where you have a possibility of growing some wealth if you're not the entrepreneurial type.

The big crisis the average amount of savings in my age group isn't enough to cover basic costs like food and shelter, much less medical care. They are screwed.

My name is from my time volunteering (which has given me a tiny LOSAP account that I'll eventually close when I decide I'm officially exiting the volunteer stuff).It's none of my business, but when I hear things like this it makes me wonder what your plans on for retirement (if you plan to retire)? Based on your user name, I might infer you are a fireman and if so you likely have a pension. If you have a pension, you've likely contributed to the markets indirectly through payroll deductions unless your employer covers 100%.

I work in the corporate world and I do not partake in 401K. A handful of events made me decide to find my own solution. If it fails, then it's on me at least.

I'm 40, my wife 41. Instead of investing, we've lived a pretty small life, our house will be paid off in about a year and we've aggressively paid off my school loans and cars leading up to aggressive house repayment. I'll be 41 with no living overhead other than property taxes/insurance/monthly utilities. In theory, I should be able to bank my income notably with a cost of living that's relatively peanuts.

We aren't world travelers, we don't have kids, our house is small, I do all of the work on our vehicles, I do all of the work on our house. I've found this works for me mentally, though I guess ask me on my death bed if it was the right decision or not. Time will tell. What I do know is, I won't be beholden to banks/markets/corporations/government on how my money grows, is managed or how/when I can do something with it.

Nope. It has been foisted on them and used as a weapon.

From the Bretton Woods agreement, and subsequently manipulated via tied to oil sales.

Gold has inherent value, paper from a bankrupt nation does not.

BRICS is gaining momentum and the $ may soon take a tumble.

Gold is the ultimate "money token", as that's what banks purchase and hoard.

I grew up with hundreds of books on the shelves but my mother’s mother must have had thousands.

I believe my grandmother hated Franklin Roosevelt more than Satan.

But over time I realized why she hated him was because FDR stood up to fascist Germany and militarist Japan, and before that he helped repeal Prohibtion.

But since I loved my grandmother I hated Roosevelt, too.

As I went to college and was exposed to history professors I could not ever have dreamed of one by one the reasons my grandmother hated FDR evaporated until only one remained.

On his own authority, by executive order, and backed by a rubber stamp Congress, the bastard not only took us off the gold standard, he commandeered all the gold bullion and gold coins.

Other nations, eventually all other nations, left the gold standard without making criminals of out of their own citizens who kept gold, and to make it worse after he ordered it all turned in at $20 an ounce he raised the official price to $35.

Then one day ten years after my grandmother had died a prosperous, loved and very old woman I had occasion to visit Fort Knox Kentucky.

I forgave FDR for commandeering all the gold on that day.

He put about half the gold hoard in the vaults of the Federal Reserve Bank of New York and the other half in the world’s largest gold vault guarded by a tank division. There it sits today.

It’s my gold. We all own it. It’s like Mount Rushmore and Yellowstone National Park.

Not that it’s any good for anything except our souls.

I'll agree to disagree with a couple of you on a couple of points...

We all have our observations, experiences, preferences and biases.

In an ideal scenario, all paths of disciplined actions would lead to security, financial included.

Lets hope that's the case for all of us.

Cheers

We all have our observations, experiences, preferences and biases.

In an ideal scenario, all paths of disciplined actions would lead to security, financial included.

Lets hope that's the case for all of us.

Cheers

“Markets are fixed" Sure they are, and always have been through human history. That's part of human nature, looking for an advantage, best of all an unearned one. But for a scam to work long term it needs to spread the wealth enough to keep the customers returning. So insiders make a pot load and outsiders who are disciplined do well over time. The the customers, who make the insiders very, very wealthy, keep coming back.

Xxxxxx

Part of my law school professor’s lecture was just what a scandalous, no good, immoral, womanizing, cruel, Hitler loving son of a bitch Joseph P. Kennedy Sr. truly was. My grandmother would have stood up and cheered! After Roosevelt she hated all the Kennedies except that poor Rosemary girl.

But in a classic example of appointing a fox to guard the chicken coop Joe Kennedy was the first head of the Securities and Exchange Commission, and he helped design a market where the little investor at least was assured the fat cats had to follow a set of definite rules designed to make it fairer.

www.sechistorical.org

www.sechistorical.org

On any given day, or month, or year the stock market is a casino,

Over longer periods of time the stock market mirrors the growth of all those large industrial companies that make America the wealthiest nation that has ever existed under the sun.

As my professor loved to reapeat, everybody that’s ever placed a long term short against the United States of America has lost the bet.

Bet on America.

If she falls your money is worthless anyway.

Xxxxxx

Part of my law school professor’s lecture was just what a scandalous, no good, immoral, womanizing, cruel, Hitler loving son of a bitch Joseph P. Kennedy Sr. truly was. My grandmother would have stood up and cheered! After Roosevelt she hated all the Kennedies except that poor Rosemary girl.

But in a classic example of appointing a fox to guard the chicken coop Joe Kennedy was the first head of the Securities and Exchange Commission, and he helped design a market where the little investor at least was assured the fat cats had to follow a set of definite rules designed to make it fairer.

Securities and Exchange Commission Historical Society

Welcome to the online museum and archive of the history of financial regulation, providing access to primary materials on the creation and growth of the regulation of the capital markets from the 20th century to the present.

On any given day, or month, or year the stock market is a casino,

Over longer periods of time the stock market mirrors the growth of all those large industrial companies that make America the wealthiest nation that has ever existed under the sun.

As my professor loved to reapeat, everybody that’s ever placed a long term short against the United States of America has lost the bet.

Bet on America.

If she falls your money is worthless anyway.

I'll agree to disagree with a couple of you on a couple of points...

We all have our observations, experiences, preferences and biases.

In an ideal scenario, all paths of disciplined actions would lead to security, financial included.

Lets hope that's the case for all of us.

Cheers

There are many ways to invest money.

For a hundred dollars you can open a savings account.

The same banks sell US savings bonds.

You can buy an ounce of silver at a pawn shop for the price of one of my cheap Marxman pipes.

But all those brokerage dealers offer an account for a hundred bucks where you can buy a piece of America’s private capitalistic wealth engine:

Over time guess which wins?

The ones who kept their gold and sustainable propertyThere are many ways to invest money.

For a hundred dollars you can open a savings account.

The same banks sell US savings bonds.

You can buy an ounce of silver at a pawn shop for the price of one of my cheap Marxman pipes.

But all those brokerage dealers offer an account for a hundred bucks where you can buy a piece of America’s private capitalistic wealth engine:

Over time guess which wins?

Are you familiar with fractional reserve lending?There are many ways to invest money.

For a hundred dollars you can open a savings account.

The same banks sell US savings bonds.

You can buy an ounce of silver at a pawn shop for the price of one of my cheap Marxman pipes.

But all those brokerage dealers offer an account for a hundred bucks where you can buy a piece of America’s private capitalistic wealth engine:

Over time guess which wins?

I pretty much live the same way. I bought enough house for me, and I paid cash for it, so no mortage expense. Having parents who lived through the Great Depression left me with no desire for fancy items, big expenses, or rampant "consumerism".My name is from my time volunteering (which has given me a tiny LOSAP account that I'll eventually close when I decide I'm officially exiting the volunteer stuff).

I work in the corporate world and I do not partake in 401K. A handful of events made me decide to find my own solution. If it fails, then it's on me at least.

I'm 40, my wife 41. Instead of investing, we've lived a pretty small life, our house will be paid off in about a year and we've aggressively paid off my school loans and cars leading up to aggressive house repayment. I'll be 41 with no living overhead other than property taxes/insurance/monthly utilities. In theory, I should be able to bank my income notably with a cost of living that's relatively peanuts.

We aren't world travelers, we don't have kids, our house is small, I do all of the work on our vehicles, I do all of the work on our house. I've found this works for me mentally, though I guess ask me on my death bed if it was the right decision or not. Time will tell. What I do know is, I won't be beholden to banks/markets/corporations/government on how my money grows, is managed or how/when I can do something with it.

My one big splurge has been pipes and tobaccos. And there's the camera gear which I used in my work and to fulfill creative pursuits. And we eat out too often, so there's that. Everything else has been bought for a necessary purpose. I carry no debt, pay off my card every month and try not to use it. But, I also invested a small inheritance which I don't touch and has grown, and made a decent amount of money partnering in developing property, which overall worked pretty well. No risk, no reward. Cash not put to work is lost buying power.

The past decade really screwed savers, and banks are not doing anything to help them unless they demand changes.

Free money is dead for the time being.

Though with declining health, I'll likely not see retirement, I've got a six figure job and live well below my means. I've paid for everything with cash since my earliest working days and have put back enough for retirement with quite a but left for my children.It's none of my business, but when I hear things like this it makes me wonder what your plans on for retirement (if you plan to retire)? Based on your user name, I might infer you are a fireman and if so you likely have a pension. If you have a pension, you've likely contributed to the markets indirectly through payroll deductions unless your employer covers 100%.

Sounds similar to how my family and I live.My name is from my time volunteering (which has given me a tiny LOSAP account that I'll eventually close when I decide I'm officially exiting the volunteer stuff).

I work in the corporate world and I do not partake in 401K. A handful of events made me decide to find my own solution. If it fails, then it's on me at least.

I'm 40, my wife 41. Instead of investing, we've lived a pretty small life, our house will be paid off in about a year and we've aggressively paid off my school loans and cars leading up to aggressive house repayment. I'll be 41 with no living overhead other than property taxes/insurance/monthly utilities. In theory, I should be able to bank my income notably with a cost of living that's relatively peanuts.

We aren't world travelers, we don't have kids, our house is small, I do all of the work on our vehicles, I do all of the work on our house. I've found this works for me mentally, though I guess ask me on my death bed if it was the right decision or not. Time will tell. What I do know is, I won't be beholden to banks/markets/corporations/government on how my money grows, is managed or how/when I can do something with it.

Once you get your affairs in order, and have a relatively decent income, retirement concerns kind of melt away. It’s easy to live when you have not strapped yourself down with all sorts of debt.Though with declining health, I'll likely not see retirement, I've got a six figure job and live well below my means. I've paid for everything with cash since my earliest working days and have put back enough for retirement with quite a but left for my children.

Sounds similar to how my family and I live.

These days people build “tiny houses” larger than my house. If you can find a house my size, the first thing people start thinking about is knocking it down or adding expansions.

I don’t really intend to ever “retire”, but I do intend to just make money doing things I enjoy without much care to income targets. I’d get too bored to ever properly retire.

And ownership of ...fertile farmland.

Land has value because it's not made anymore.