Besides… if Germain and Esoterica were just another blend always on the shelf, and people could just smoke Stonehaven or Penzance everyday, they wouldn’t be special. Actually, I’m not the biggest Esoterica fan, as I’m not a baptized licorice fan. But, I see what they do and how it affects people’s perceptions. People gobble that shit up when it comes out. Ha ha.Exactly, and on a smaller scale a ma and pa can focus on quality on a more personal level. For such a small industry it keeps them in the luxury range.

Wealth and incorporating is not always the goal of a business. Sometimes it’s the pride and happiness the work brings.

I don’t begrudge Germains or McClellands for the way they ran/run their businesses. Everyone defines success differently.

UK Market Germain's Availability?

- Thread starter JohnClyde

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

See this is where I struggle with understanding Germains.Whether someone pays $20 for a tin or $200 a tin in their marketplace, I’d have to believe germain doesn’t see a different purchase price from their vendor. That would just Brew toxicity.

As I understand it tobacco in the UK is roughly twice the price of the US. I recently put in an order which (apart from some pipe cleaners) was entirely tobacco. Of the £300 nearly exactly £50 was tax.

So either retailers are making significantly less is the US or (I suspect) both retailer & manufacturer make more profit from the UK - which makes sense given that there's way less tobacco, so less competition.

Selling to the US (or China) is a much bigger market, so it's effectively a bulk discount.

Different retailers cost a bit more or less, & I think you're spot on that that reflects a higher or lower mark up - within a country - not a different offering price from the manufacturer.

But if they make more money per pound from the UK, which I think they do, GH/SG's approach to keeping the home fires burning makes way more sense to me.

Dunno, maybe I'm missing something...?

Bigger orders, I could see. US or China placing manufacture orders in larger quantities than other places but I’d still have to believe the price per unit doesn’t change much. Just easier to make a single large order compared to multiple small orders. I could see that as a nice efficiency at least.

The prices are ludicrous here because of tobacco taxation. It's usually $1 a gram for any blend, regardless of whether it is Germains or Captain Black Grape! I don't believe they are marking up their products for export.Lucky you! I'm skeptical on that as well, I can't make that make sense either. GQ just got a delivery which was so small that they were only offering Uncle Tom's in 25g bags. (Grrr!)

What are the prices like in Singapore -? Are they making a killing?

Wow! That's rubbish. No, I should think they're probably not at that point (though I think they're marking them down for the US - I can't make the sums make sense otherwise). But at that point, given volume, I can understand why Asia might trump the home market.The prices are ludicrous here because of tobacco taxation. It's usually $1 a gram for any blend, regardless of whether it is Germains or Captain Black Grape! I don't believe they are marking up their products for export.

&, given the price, I'm glad for you. You clearly deserve the good stuff!

I'm not in lock step with your rationale. We don't know how many middlemen it passes through in one verses the other, and we don't know the mark ups in all retailers. So, we would just be making wild guesses. I know from just leaning against the counter at the Briary while they talk that they don't make anything off of tobaccos, at least to hear them talk. No taxes here to speak of, and they will always let us know that they just sell them as a courtesy to their customers. Pipes is where most of these places make their money.Selling to the US (or China) is a much bigger market, so it's effectively a bulk discount.

Other B&Ms without an online presence will have their tobaccos priced 3-4x's what we see online, but they have great walk in traffic because of their vacation destination locations.

As I've been given to understand, Germain's is a small operation that's working at capacity. From what I've observed over the years, they've made commitments that overextended that capacity. So, depending on which contract they're supplying at the moment, others will get set back. It's not like Germain's, as opposed to Esoterica, is plentiful in the States.

These days it seems that all British made blends are in short supply in the US regardless of the causes. It's a marked contrast from 7-8 years ago.

These days it seems that all British made blends are in short supply in the US regardless of the causes. It's a marked contrast from 7-8 years ago.

I don't imagine UK tobacconists make very much money from pipe sales at all (based on stock movement with the sellers I use), so that might be the difference.We don't know how many middlemen it passes through in one verses the other, and we don't know the mark ups in all retailers. So, we would just be making wild guesses. I know from just leaning against the counter at the Briary while they talk that they don't make anything off of tobaccos, at least to hear them talk.

I'm really just playing with numbers here - so I may well be very wide of the mark.

That said, using nice round numbers, if 50g in the UK is £15, that leaves £12 after tax. Assuming the split is around 50:50 then that's £6 each.

With no US tax, the tobacconist in the US would be making less than £1.50 for Germains to keep getting £6 (because shipping should probably be factored in too).

The assumption here is that Germains are getting around 50%. I'd suppose that because otherwise - if the retailer proportion was higher - I'd expect to see more undercutting on the market, but that doesn't seem to happen at all. We don't get tobacco sales like you do either.

But that's all a bunch of assumptions & guessing. I'm absolutely not an expert & I'm not wedded to the idea. I'd be super-interested to know either way!

Interesting discussion here.

I'm wondering if Germains themselves are aware/care that much of the product backordered for the UK market has for the last two years been exported?

I presume our big taxes have historically protected the market from oversea buyers. From what I gather that changed recently and now new overseas buyers are happy to pay.

I've been told by two separate UK tobacconists with an online presence that the bulk of Germains coming in isn't even making it to their websites. Both explained that they have established customers from overseas who continually spend large amounts and take 'anything' Germains as soon as it arrives, maybe apart from the less appealing cavendish fare.

It was a bit gutting to walk in to one tobacconist and see all those gold tins and bags being taken out of one box and being immediately parcelled up to go off in another! They were kind enough to let me grab some Medium Flake and Brown Flake, but it was only then by watching online over the next few days that I realised the stock was indeed getting to UK tobacconists, but it wasn't hitting the shelves/websites. Kind of understandable with a dwindling UK market and most b&m tobacconists going out of business.

Which brings me back to whether this is a temporary thing? Will there eventually be enough product to suffice overseas buyers AND allow online UK tobacconists to have enough to get the UK market back to where it was?

Or is this how it's going to be, that the more desirable blends are permanently 'sold out' and its a mad 30 second scramble every time RDF switches to 'in stock'?

I'm wondering if Germains themselves are aware/care that much of the product backordered for the UK market has for the last two years been exported?

I presume our big taxes have historically protected the market from oversea buyers. From what I gather that changed recently and now new overseas buyers are happy to pay.

I've been told by two separate UK tobacconists with an online presence that the bulk of Germains coming in isn't even making it to their websites. Both explained that they have established customers from overseas who continually spend large amounts and take 'anything' Germains as soon as it arrives, maybe apart from the less appealing cavendish fare.

It was a bit gutting to walk in to one tobacconist and see all those gold tins and bags being taken out of one box and being immediately parcelled up to go off in another! They were kind enough to let me grab some Medium Flake and Brown Flake, but it was only then by watching online over the next few days that I realised the stock was indeed getting to UK tobacconists, but it wasn't hitting the shelves/websites. Kind of understandable with a dwindling UK market and most b&m tobacconists going out of business.

Which brings me back to whether this is a temporary thing? Will there eventually be enough product to suffice overseas buyers AND allow online UK tobacconists to have enough to get the UK market back to where it was?

Or is this how it's going to be, that the more desirable blends are permanently 'sold out' and its a mad 30 second scramble every time RDF switches to 'in stock'?

not quite sure where the 3 gbp on 50 grams comes from.I don't imagine UK tobacconists make very much money from pipe sales at all (based on stock movement with the sellers I use), so that might be the difference.

I'm really just playing with numbers here - so I may well be very wide of the mark.

That said, using nice round numbers, if 50g in the UK is £15, that leaves £12 after tax. Assuming the split is around 50:50 then that's £6 each.

With no US tax, the tobacconist in the US would be making less than £1.50 for Germains to keep getting £6 (because shipping should probably be factored in too).

The assumption here is that Germains are getting around 50%. I'd suppose that because otherwise - if the retailer proportion was higher - I'd expect to see more undercutting on the market, but that doesn't seem to happen at all. We don't get tobacco sales like you do either.

But that's all a bunch of assumptions & guessing. I'm absolutely not an expert & I'm not wedded to the idea. I'd be super-interested to know either way!

in the UK

according to this the tax is 1.34 gbp per 10 gr x 5=6.70 plus 20% vat on the total of pre tax price and added tax per 50gr tin ,so 8 gbp plus what ever vat is on the pre tax price

So probably nearer 10GBP

Tobacco duties are levied on purchases of cigarettes, hand-rolled tobacco, cigars and other forms of tobacco. In 2019-20 tobacco duties raised £9.7 billion. That represented 1.2 per cent of all receipts and was equivalent to 0.4 per cent of national income. Duty on cigarettes accounts for the majority of all tobacco duty receipts.

There are different rates for each type of product:

- the rate on cigarettes is 16.5 per cent of the retail price plus £4.90 on a packet of 20;

- the rate on cigars is £3.05 for a 10g cigar;

- the rate on hand-rolling tobacco is £8.14 for a 30g packet; and

- the rate on other smoking and chewing tobacco is £4.03 for a 30g packet.

Last edited:

i know this is referencing cigarettes but it gives an idea to our non UK members of the levels of tax in the UK

the-tma.org.uk

the-tma.org.uk

The Tobacco Manufacturers’ Association (TMA) | Taxation

the-tma.org.uk

the-tma.org.uk

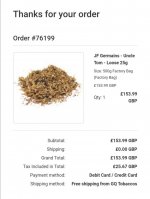

thats only showing the vat on the order not the tobacco taxes that are a large part of the 153.99Hello! Wow, thanks!

I was basing it on receipts, but trying to keep the numbers nice & round.

View attachment 102936

It sounds to me as though the receipt isn't telling anywhere near the whole story though - so I've definitely learnt something today. Thank you!

And yes in your example of 15gbp per tin the vat at 20% =3gbp

Last edited:

I really do learn something every day here. Thank you!thats only showing the vat on the order not the tobacco taxes that are a large part of the 153.99

And yes in your example of 15gbp per tin the vat at 20% =3gbp