Cigar Aficionado reports discouraging news from a tobacco conglomerate that makes pipe mixtures we probably all enjoy.

Click here.

Jay

Click here.

Jay

You can by AroEnglish Inc. They’ve been flat since early 2020 and don’t expect any net profit or loss. The company is valued at $3.7m but I’ve got an in at the company and I could probably convince they owners to sell for less.I wish I could buy a company and just be flat rather than at a net profit loss.

Hell, I wish I could just buy a company.

But it doesn't read so dire to me. Profits are minimally down and easily explained, as in the article, by a weakened USD. As to flat net profits, I'm not sure other companies in this size bracket and purchasing another in the same quarter, if they generally see gain, flat or loss net profit for the year, so I can't comment to whether that's good or bad, but to my "not a corporate business brain", flat net sounds OK considering buying another company and you still make the same net as the year prior when you didn't purchase another company (assuming they didn't last year).

Well, whoever is at the wheel thought it worthwhile to buy another company.

Keep in mind that flat sales do not equal flat profits

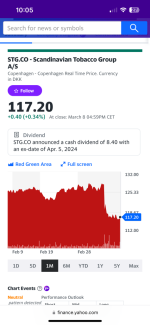

They bought a company and they very much experienced a giant loss of profit. Re-read and you’ll see that the sales were flat, not the profit. This is very bad for STG. If your sales stay the same but your profits drop nearly 20%, that’s real bad news.I wish I could buy a company and just be flat rather than at a net profit loss.

Hell, I wish I could just buy a company.

But it doesn't read so dire to me. Profits are minimally down and easily explained, as in the article, by a weakened USD. As to flat net profits, I'm not sure other companies in this size bracket and purchasing another in the same quarter, if they generally see gain, flat or loss net profit for the year, so I can't comment to whether that's good or bad, but to my "not a corporate business brain", flat net sounds OK considering buying another company and you still make the same net as the year prior when you didn't purchase another company (assuming they didn't last year).

I think the Air Police might have something to say about that...don't give them any ideas!Nothing but air is free.

I wonder if they might have some of the same accountants that work in Hollywood?Doesn’t look all that bad. They purchased another company, the cost of which weighed against their profits.

I’ve tried a few of their pipe tobaccos and am not a fan.

Tak for the insight.Tobacco and oil may, most probably, not be among the most 'easy profitable' businesses these days and especially in the future..

But some of the original and present STG owners, such as the Augustinus family (and foundation), who, with present name STG, have been in the tobacco business since 1750, have also cleverly chosen to spread investments to more futureproof areas, such as eg entertainment and medicine and so the 'tobacco'foundation is among the wealthiest here, like Maersk, Novo and Carlsberg.

You mean like "no net profits" accounting? "Creative Accounting", even more than blowjobs, rules Hollywood. Creative Accounting is not unique to Hollywood, any more than blowjobs. Sadly in this day and age, Creative Accounting provides much more pleasure and joy than er...umm...well, you know...I wonder if they might have some of the same accountants that work in Hollywood?