Many of us mention buying on the Bay but it is my understanding that the seller after a $600 limit, the feds will issue a 1099 that may complicate your tax picture. Let me know if I am wrong.

E Bay Sales

- Thread starter Pipeoff

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingPipes.com Updates

Watch for Updates Twice a Week

I did receive a 1099 for selling. Nothing on purchases - those are now taxed at the time of purchase. But I'm not sure I understand the phrasing of your question.

I did receive a 1099 for selling. Nothing on purchases - those are now taxed at the time of purchase. But I'm not sure I understand the phrasing of your question.

If the seller is issued a 1099 after reaching this limit it is my understanding that Income tax is due. ?

Tax is always due, whether you receive a 1099 or not. This shouldn’t be a change for tax filing assuming you were claiming income previously.

You are correct, the tax at time of sale by seller will cover on a state level. Federal income tax is due depending on your income level. It sounds like EBay has recently been required to report to the Feds over $600. All income will require keeping accurate records as to profit from sales going back 10 years. This fact will be explained in detail by the tax man at time of a potential audit. I am not a tax accountant perhaps one can jump in here.Tax is always due, whether you receive a 1099 or not. This shouldn’t be a change for tax filing assuming you were claiming income previously.

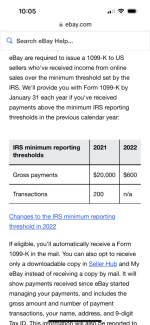

Every marketplace is required to submit a 1099 for sellers who cross the $600 threshold. However, the non-requirement in previous years doesn’t change the fact that a seller still needed to include this income for tax purposes.

It just means the marketplace is creating 1099 for sellers for income they already should have been claiming. I actually think it makes things easier since the marketplace generated the 1099 and this should match your transaction record making record keeping for that bucket of income very simple.

It just means the marketplace is creating 1099 for sellers for income they already should have been claiming. I actually think it makes things easier since the marketplace generated the 1099 and this should match your transaction record making record keeping for that bucket of income very simple.

Packing to move to a new house last year made me realize the size of my pipe collection had gotten out of hand so I have been slowly thinning the herd by selling on eBay.

This past year eBay did indeed change their policy as the OP pointed out. I'm expecting a 1099 at year's end that will definitely reduce any gains made by selling off some of my humble collection.

While a significant part of my pipes are estate pipes purchased on eBay, I'd never sold anything there before this year. It's been an interesting experience. I've been shocked by how often a buyer wins an auction but doesn't bother to pay.

This past year eBay did indeed change their policy as the OP pointed out. I'm expecting a 1099 at year's end that will definitely reduce any gains made by selling off some of my humble collection.

While a significant part of my pipes are estate pipes purchased on eBay, I'd never sold anything there before this year. It's been an interesting experience. I've been shocked by how often a buyer wins an auction but doesn't bother to pay.

I can't imagine the federal government would get involved in this. It has to be they are now requiring eBay to do the sending out of the 1099's.

They’ll issue the 1099’s . You still get to account for cost of goods sold with the taxes , so not like you pay tax on the gross amount . I can and plan on taking a tax loss on my collectible pipes to offset other collectible gains within the tax code . Overly complicated for most tax filers imho but they squeezing the lemon

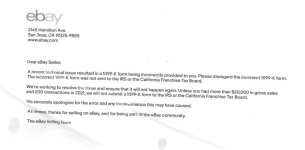

I’ve heard the 600 threshold … eBay is advocating for a higher number , vast majority of eBay sellers are under 3000 in salesAccording to their communications with me earlier this year, $20,000 in sales was the instigator.

Understanding Your Form 1099-K | Internal Revenue Service

Understand Form 1099-K, Payment Card and Third Party Network Transactions, and what you should do if you receive one.

At one point the IRS was supposed to be notified if a seller, eBay, whatever, made income of $600 or more. There was such a huge reaction to this that the threshold was raised to the $20,000 mark.

Income is income and you're supposed to report it. But below $20,000 it's an honor system which will, if not honored and if discovered, result in lovely penalties being imposed on the person under reporting income.

I had my bout with the IRS back in 1985, and with help and advice from two IRS auditors whom I, by happenstance, met at a bar, was able to win.

But I was in the right according to the tax code and the auditor I was up against was a piece of work.

Since then I keep very careful and complete records and pay everything legally required. I don't play games of chance with the IRS.

Income is income and you're supposed to report it. But below $20,000 it's an honor system which will, if not honored and if discovered, result in lovely penalties being imposed on the person under reporting income.

I had my bout with the IRS back in 1985, and with help and advice from two IRS auditors whom I, by happenstance, met at a bar, was able to win.

But I was in the right according to the tax code and the auditor I was up against was a piece of work.

Since then I keep very careful and complete records and pay everything legally required. I don't play games of chance with the IRS.

Yep- $600.................. Sell one item in a year over $600 and the taxman cometh........... Creates a LOT of unnecessary paperwork, but hey, we got lots more IRS agents coming soon!!...........Still 600 as far as I can see from eBay itself . Pain in ass for small time sellers