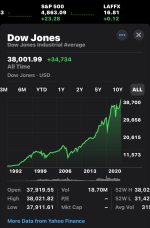

The market is sp irrational right now there's no way to justify it in terms of P/E ratio, pretty much any kind of common sense indicator. It's basically propped up by a few companies running on AI hopium. I agree bad idea to bet against the USA long term, but none of this adds up.

The S&P500’s p/e is what, 25? That’s just 5 points above what’s supposed to be carefully optimistic. Of course I know that the S&P500's growth is driven by the Magnificent Seven but what's the alternative for someone looking to build savings for the future? Cash? HYSAs/CDs/MMFs? Bonds?

I only started investing 2 year ago, so one year was a net zero, and the next was a spectacular bull. I am not too comfortable with either but see it as good mental training.

I think p/e ratios considered reasonable (15-20) may be shifted upwards, we'll see.

I went back and found p/e ratios for Japan in the 80s-90s and .com in late 90s and they were spectacularly crazy, in the hundreds, while EVEN nVidia has a p/e ratio of just under 80 today. The

whole Nikkei 225 index had a p/e of nearly 70, investors had to wait 30 years to start getting their money back - likely a lot died before they ever did. Diversification solves a big part of this problem. The Greek index was/is so bad that people who invested between 1998 and 2008 will likely

never get their money back.

I had a position in nVidia which I sold after it doubled, just because I wanted to prove a point to my wife that investing is more than "looking at the numbers". But the point remains, leading up to the .com crash there were companies with p/e ratios of 200-500, which in plain English means they were little more than an idea sketched on used toilet paper valued at billions.

I do believe the Mag Seven are overvalued, but not THAT BAD. nVidia is not even the most expensive in terms of p/e (Amazon is), but MS, Google, Apple, Meta, Tesla are hovering between 30-40. Amazon is the other very expensive one but still at 80 p/e. Even Buffett's own stock is not a value stock right now, yet I am eagerly buying it

Learning about and getting into low cost diversified index investing has been a life changer for me, without a shred of exaggeration.