Well, then there’s this headline today…

View attachment 413846

The future is a black wall, and we cannot see one inch beyond it.

——

The

Dow Jones Industrial Average (DJIA) first closed above 1,000 points on November 14, 1972, finishing at 1,003.16, a significant milestone that occurred amid positive economic news and investors' optimism for American business. This historic moment followed earlier attempts, including a brief breach of the 1,000 mark in January 1966, but November 1972 was when the index sustained that level at the close of trading.

—-

1973–1974 oil crisis

The 1973 OPEC oil embargo led to a severe stock market crash that lasted from January 1973 to December 1974.

- Cause: An oil embargo by OPEC members, aimed at countries supporting Israel in the Yom Kippur War, quadrupled oil prices.

- Recession: The price shock contributed to a recession from 1973 to 1975, with high inflation and unemployment.

- Dow low: The DJIA lost over 45% of its value during the bear market, reaching a low of 577.60 on December 6, 1974. This was the worst bear market since the Great Depression.

——

Right now, on this day, my wife and I can and do have 90% of our assets in 4 1/4% FDIC insured accounts.

This is contrary to the investment plan I used for forty years of having 90% in blue chip USA common stocks.

And most of the reason, is ghost of Miss Charlotte reciting about the lesson of the 1929 stock crash that she taught us 55 years ago ——

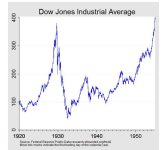

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929. After prices peaked, economist Irving Fisher proclaimed, "stock prices have reached 'what looks like a permanently high plateau. '" The epic boom ended in a cataclysmic bust.

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

www.federalreservehistory.org

Every major crop planted on every acre of farm land in the entire nation of the USA will lose from $400 an acre at worst to $100 an acre at best. All of it. Every acre. Every major crop.

Last year our ports handled 3.2 trillion of exports and 4.2 trillion of imports.

How’s that looking?

What was the experience of Smoot Hawley?

—-

The average sale price for a new home in the U.S. was $487,300 in July 2025, according to the

U.S. Census Bureau. This figure represents a slight decrease from the previous month, highlighting recent shifts in the new housing market. It's important to note that this "average" or "mean" price can be influenced by a small number of very expensive homes, which is why the

median price (which represents the midpoint of all sales) can provide a different perspective on home affordability and market conditions.

Key Figures for July 2025

- Average Sale Price: $487,300

- Median Sale Price: $403,800

——-

The average new car price in the United States was approximately $48,907 in June 2025, according to Kelley Blue Book. While prices have generally trended upward since 2020, recent data shows them remaining stable with slight month-to-month changes and a significant increase in manufacturer incentives like rebates.

——

Wages in Manufacturing in the United States remained unchanged at 28.96 USD/Hour in July. Wages in Manufacturing in the United States averaged 9.44 USD/Hour from 1939 until 2025, reaching an all time high of 28.96 USD/Hour in June of 2025 and a record low of 0.48 USD/Hour in July of 1939.

——

The average income in the U.S. for 2025 varies depending on the source and definition, but generally, a common figure is around $66,000 to $69,000 for a median household income and approximately $53,000 to $69,000 for median individual income. Median weekly earnings for full-time workers were reported at $1,194 in the first quarter of 2025, which is about $62,000 annually.

——

My wife had a procedure today that ought to make her back better for about six months and we are itching to travel, to see Yellowstone, and visit where my great grandfather advanced in Company M of the 12th Missouri Cavalry against Indians thicker than fiddlers in hell led by Roman Nose at the Battle of the Powder River on September 8, 1865.

—-

In his words, Cole ordered the train, "out of the timber and corralled", and the 12th Missouri Volunteer Cavalry "to skirmish through the woods along the river bank to drive out a body of Indians who were posted in the woods". A German immigrant, First Lieutenant Charles H. Springer, of Company B, 12th Missouri Cavalry, said that this took place at about 1:00 p.m. Springer, who was with the 12th Missouri clearing out the woods, described the scene in front of the command: "The whole bottom and hills in advance were covered full of Indians, or to use a soldiers expression, they were thicker than fiddlers in hell". The 12th Missouri, 15th Kansas, 16th Kansas, and one battalion of the 2nd Missouri Light Artillery along with both artillery sections advanced simultaneously toward the warriors.

en.m.wikipedia.org

—-

Labor Day 1929 was the stock market market high until 1954.

The typical young family you see, has to borrow about six or seven times their household income to build Mama a good nest for her children.

Each new vehicle they buy costs most of a year’s income.

They’d better not be farmers, I’d reckon.

Although it’s impossible to predict tomorrow much less a month away, the Fed will start lowering rates soon.

And when they do, much of the 18 or so trillion in household savings and 50 or so trillion held by businesses will pour into stocks and lower rates will mean more half million dollar homes.

Which will be fine and dandy until the next 1929-33 or 2007-9 crash.

What would we pay for next year’s newspaper just before Labor Day, 2026?