The results of a poll of 500 Nebraskans are being touted by anti-smoking forces as justification for tobacco tax increases statewide but the International Premium Cigar & Pipe Retailers Association is touting those results as ‘phony.’

The poll was paid for by the Robert Wood Johnson Foundation, an $8.4 billion organization that gets its funds from Johnson & Johnson which makes the leading brand of anti-smoking medication. Released last week, the poll was conducted by a coalition of anti-smoking organizations. It says 73 percent of the Nebraska voters surveyed favor raising the tax on cigarettes by $1.35 per pack of cigarettes. The current Nebraska tax on cigarettes is 64 cents per pack. The coalition is urging the Nebraska legislature to increase tobacco taxes across the board.

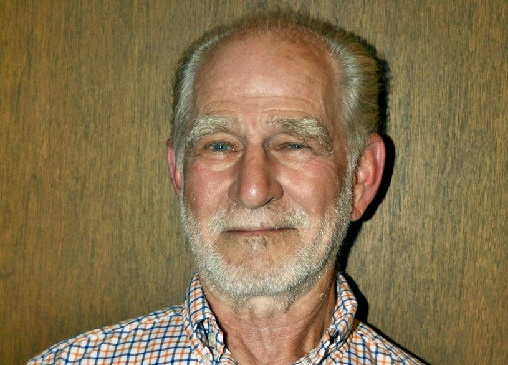

"The conclusions drawn from the poll results are phony for many reasons," said Chris McCalla, legislative director of the IPCPR. "First of all, the poll’s funding source has a vested interest in forcing people to give up the pleasure of smoking which will result from higher tobacco taxes," said Chris McCalla, legislative director of the IPCPR. "Second, they are saying that 365 people should dictate higher taxes on those tobacco products by the citizens of Nebraska. Ridiculous!"

McCalla said the questions in the poll were skewed to lead the participants to reach the conclusions that the coalition and funding source wanted in the first place.

"Any increase in tobacco taxes will cause sales to fall which will result in lost jobs, lost businesses and lost tax revenues, not increased revenues as the coalition claims. That’s not only common sense, it is a mathematical certainty," he said. "You can’t have it both ways. For example, federal tobacco taxes currently fund children’s health programs and any decrease in those tax revenues would cause a shortfall in funding those programs."

McCalla added that the IPCPR is an association of independent cigar store owners and manufacturers, most of whom are small, mom-and-pop tobacconists who primarily sell premium cigars, pipes and tobacco.

"The coalition is pulling numbers out of a hat when they claim that a tax increase would prevent more children from smoking and save on so-called tobacco-related health care and smoking-caused deaths. They make statements that simply cannot be proven. But, by saying them often enough, many people tend to believe what they say although there are no facts to support their claims," McCalla said.

Thanks for posting yet another example of our society’s inverted reasoning; and thanks for keeping these issues before the pipe smoking public.

As of 2009, Nebraska had an estimated population of 1.8 million people. So the Robert Wood Johnson Foundation has come to this conclusion, based upon the findings of a survey of 0.03% of the population.

This survey tells you more about the people asking the questions, than those answering them?