Contrary to a previous post, the pipe tobacco tax hike has not been reintroduced at any point in the last week. A nicotine provision that would affect vapor, etc. has been reintroduced. Note that the previous post cited a source that gave almost no information and the headline itself reads "Nicotine Tax Thrown Back in..."

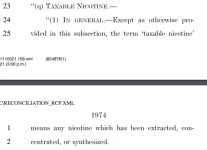

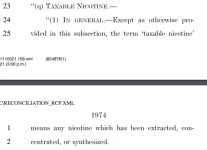

Here is the text of the most recent draft itself. Do a control + F for "tobacco" and you'll find the exemption to the tax for traditional tobacco products. If you ctrl + F for "tobacco" in the previous draft --- THAT is the Tobacco Equity Act. What exists in the current bill is a nicotine tax for hitting vapor and other distillates (see screenshot of the text itself).

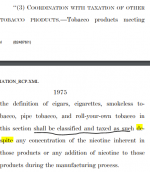

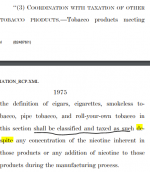

To answer your question about whether any nicotine-containing product is caught in this provision, the text specifically exempts pipe tobacco (and cigars, etc.) even though they contain nicotine:

If you need a summary, here's an article by Seek Alpha, which is a reputable company for business information. This article is behind a paywall so here's a screenshot.

I would suggest to anyone wanting to post regarding legislation to cite to primary sources or at least reputable sources that include citations to primary sources.

Here is the text of the most recent draft itself. Do a control + F for "tobacco" and you'll find the exemption to the tax for traditional tobacco products. If you ctrl + F for "tobacco" in the previous draft --- THAT is the Tobacco Equity Act. What exists in the current bill is a nicotine tax for hitting vapor and other distillates (see screenshot of the text itself).

To answer your question about whether any nicotine-containing product is caught in this provision, the text specifically exempts pipe tobacco (and cigars, etc.) even though they contain nicotine:

If you need a summary, here's an article by Seek Alpha, which is a reputable company for business information. This article is behind a paywall so here's a screenshot.

I would suggest to anyone wanting to post regarding legislation to cite to primary sources or at least reputable sources that include citations to primary sources.

Last edited: