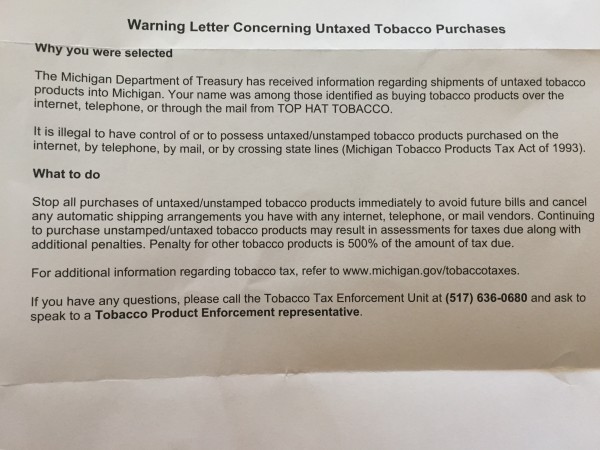

Tax Warning

- Thread starter krizzose

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

I would ask Tophat why they are reporting to the Michigan tax man. I would also ask who else they are reporting to and then warn the internet pipe community. The last thing anyone wants is to be put on a list.

If you buy ANYTHING online.....they know who you are.I would ask Tophat why they are reporting to the Michigan tax man. I would also ask who else they are reporting to and then warn the internet pipe community. The last thing anyone wants is to be put on a list

At this point, it doesn't really matter. It is what it is.

I consider it a gift.How is it that I always end up hanging out with the trouble makers and ne’er do wells?

Every time this issue presents itself, someone states how these prohibitions are going to be good for B&Ms. I believe this is not quite true. First, many of us no longer have B&Ms available to us. For those that are buying from out of state B&Ms you will suffer under the same restrictions and those business that rely on this as part of their business stream will suffer accordingly.

Well, let's hope not. That "gravy train," (please, tell me where I can hop aboard that one?), is what helps all of the businesses here (who use the Internet for a portion or all of their sales), pay for their advertising here on pipesmagazine.com. I'd sure hate to lose my job and this great forum. And no sir, it would not be good for the B&M's either for what I thought would be obvious reasons. In case you have not heard, kania, the tobacco Nazi's are after all of us.Good for the B&M's. Just wait until they just stop internet tobacco sales altogether. Most of you have maybe 2-4 years to go until the gravy train ends.-kanaia

I believe the common perception of "gravy train" has been successfully manipulated by the social engineers to now mean anyone who is not either in massive debt or in abject poverty.That "gravy train," (please, tell me where I can hop aboard that one?)

Wow! Just seeing that made me sick to my stomach.

And how is it that this falls on you? You’re just a paying customer, it’s not your responsibility to make sure they properly charged you for taxes, is that not up to the vendors?

And how is it that this falls on you? You’re just a paying customer, it’s not your responsibility to make sure they properly charged you for taxes, is that not up to the vendors?

Probably, but if Top Hat isn't in Michigan, I imagine there's a lot more legal hoops to go through. Threatening the citizenry is so much more effective :roll:...is that not up to the vendors?

As has been previously discussed here, by me and others, there is an interstate compact that some, but not all states belong to. These seem to be clustered in the Midwest. I do not know all the states that are members.

Here is what happened. Top Hat is required by the state of Missouri to report out of state sales (not subject to sales tax in Missouri) to the State of Missouri. Missouri then shares that information with other states that are members of the compact. Michigan is one. I know that Illinois and Wisconsin are and I am certain that there are others.

This is the same buzz saw Iwan Ries has run into. It may be a distinction without a difference to those in the position of the OP, but Top Hat did not report him to the state of Michigan. Missouri did, using paperwork that Top Hat has to file to stay in business.

This has been going on for several years now. Nothing new.

Here is what happened. Top Hat is required by the state of Missouri to report out of state sales (not subject to sales tax in Missouri) to the State of Missouri. Missouri then shares that information with other states that are members of the compact. Michigan is one. I know that Illinois and Wisconsin are and I am certain that there are others.

This is the same buzz saw Iwan Ries has run into. It may be a distinction without a difference to those in the position of the OP, but Top Hat did not report him to the state of Michigan. Missouri did, using paperwork that Top Hat has to file to stay in business.

This has been going on for several years now. Nothing new.

Then there are the Model Railroad Product Enforcement Unit, the Crocheting Club Product Enforcement Unit, the Potters Product Enforcement Unit, and the Sewing Machine Product Enforcement Unit, Piano Playing Product ... and so on. You're a law breaker, unless you're sending your money to them.

Could not this be: Hitting RYO tobacco sold as pipe tobacco, thus the supplier and vendor are being targeted? Not implying that what was ordered was not up to snuff on taxes.

And that would be a different kettle of fish from sales tax, which ogs writes of above.

And that would be a different kettle of fish from sales tax, which ogs writes of above.

- Status

- Not open for further replies.