By C. R. S. Lyles Let’s face it: smoking is not collectively "in vogue" anymore. Yet the irony of the fact is that the matchslingers of this world, who often […]

Read moreGov. Ed Rendell’s budget for Pennsylvania’s 2009-2010 fiscal year that begins in two weeks will be looking in part to increased and new taxes on cigarette and cigar smokers for […]

Read moreIt may sound like the theme of a Jim Carrey comedy – First, we ban smoking, then we raise tobacco taxes – but members of the International Premium Cigar & […]

Read moreStop a 775% Tax Increase on Pipe Tobacco! H.R. 4439, the Tobacco Tax Parity Act of 2010 was introduced on January 13, 2010 and would raise the tax on pipe […]

Read moreSacramento, CA (PRWEB) June 20, 2009 — California legislators are grasping at tax straws that don’t exist as they seek to raise billions of dollars that don’t exist for a […]

Read moreThe state switches to a punitive weight-based tax on many tobacco products, which benefits Philip Morris and penalizes the smaller producers. AUSTIN, Texas, May 27 /PRNewswire/ — The Texas Senate […]

Read moreSmokingpipes.com Updates

36 Fresh Tsuge Pipes |

120 Fresh Peterson Pipes |

12 Fresh Ser Jacopo Pipes |

4 Fresh Scott Thile Pipes |

36 Fresh Estate Pipes |

Site Sponsors

Recent Posts

His grandfather came to the US with a $50 gold coin in his shoe, opened up a cigar shop, and his most famous customer was Babe Ruth. He holds the record for the longest slow smoke in the world at over 24 hours, and he is the only man who stopped Chuck Norris from round-house kicking the Nording Pipe Statue. The most interesting man in the world, Jonathan Goldsmith, stopped by the Chicago Pipe Show this year to get kissed on the cheek by Neal Osborn. Wait, what? OK, I kid. Jonathan came to honor his friend and fishing buddy Steve Norse of Vermont Freehand at the annual Doctors and Masters of Pipes award dinner. Steve was one of the two recipients of the Masters of Pipes award and asked Johnathan to show up and add some color to his acceptance speech. Slightly overshadowed but no less important! Jay Furman was also honored as this year’s hobbyist Master of Pipes, joining me and a pipe-star-studded list of great contributors to the hobby and profession of pipes. Jay is a character in his own right. While I don’t know him as well as I would like, I’ve learned that he’s a kind-hearted collector who started the Artisan Pipe Makers Club, a place where new artisans learn, grow, and are challenged. There are around 60 artisans who participate, collaborate, and learn. Jay and Mike Bishop also started the Long Island Pipe Club, which has around 50 members and meets twice a month on different sides of the island. What is not featured here are pictures of the Doctors of Pipes. Both recipients were unable to attend: Marco Parascenzo – Doctor of Pipes, Trade/Industry Regis MacCafferty – Doctor of Pipes, Hobby Please join us in congratulating these newly inducted Doctors and Masters of Pipes. It is a great honor, and each of these men embodies what our hobby and industry strive to do: grow, educate, and cultivate its future. I encourage everyone to attend the dinner next year as it’s always illuminating. And now, on with the show. Sort of. You may be wondering what the most interesting pipe smoker in the world smokes…. I didn’t miss the opportunity to chat with this incredibly nice man, whom Brian Levine and I also remembered from one of our favorite TV shows, the A-Team. He was also in many other shows from the 80s, such as Magnum PI, Murder She Wrote, Dallas, and MacGyver, just to name a few. Jonathan: I actually enjoy simple and readily available tobacco like Captain Black or some black cavendish from my local cigar and pipe shop in Vermont. What about your first pipe? Jonathan: I picked up my first pipe; I think it was a billiard when I was in London many years ago at a place called James Fox. How often do you smoke? Jonathan: Almost every day. I enjoy a pipe in the morning and a cigar in the afternoon. I want to thank Jonathan Goldsmith for taking a few minutes to sit down with me and being gracious enough to snap pictures with many of us at the show; it was a ton of fun and made this year’s show even more memorable! This year, the Chicago Pipe Show kicked it up a notch with a new location, new signage, new pre-registration and payment system, new show executive staff, and lots of new surprises. Now, Tim Garrity, President of the Chicagoland Pipe Club, tells me that over 400 attendees were at the show, but they are still tabulating the numbers too, so this is subject to getting updated and expanded. We do have our dates for next year at this same location – the first weekend of May at the Hyatt Regency, Chicago O’Hare. Of course, like any good Chicago show, there was plenty of room hopping and the announcement board. The signage this year was super helpful in knowing where to go when to go, and what tables our favorite vendors were at. While the show was jam-packed, the spacing of the tables allowed everyone to move around freely and didn’t feel over-crowded as the tables and isles were spaced out to allow room for vendors and collectors to stretch out. The smoking tent was hopping all the time, but luckily, air flow and some great air purifiers by Lake Air kept it fresh. As usual, there was a great sample table with tons of things to try in the tent, and on your way to the tent, there was a conveniently placed cash bar. This year the tent was 25% bigger than last year, although you wouldn’t notice because there were more people at the show! Kaywoodie is under new Management. At the show, I chatted with Nathan “Greywoodie” Davis about how he came to take over the 173-year-old company. Tell me how this happened. Nathan: This month is my 5th anniversary of Greywoodie opening. I was friends with Bill and had a huge collection of Kaywoodies – I approached him about having them available outside of brick and mortar. He had no online presence and didn’t sell direct. He said if I wanted them to be more available, the best thing I could do was quit my job and sell them myself. He was mostly kidding because I had a really good job in the legal profession, but I wasn’t happy so one day I did give him a call and said “hey whats your minimum order,” and he said “You didn’t just quit your job because I was joking?” I did and I started out that way as an online retailer. So, in working with him, we did exclusives, and I learned about pipe making from him, both production and hand-made. We brought back some historical lines as well, and soon enough, I was helping to make the pipes I was buying from him. It was great for him to get my labor […]

Welcome to The Pipes Magazine Radio Show Episode 605. Our featured interview tonight is with Pete Prevost. Pete is a pipe maker and the President of the BriarWorks pipe factory in Columbia Tennessee. BriarWorks is a a pipe maker co-op with several other pipe makers, including Todd Johnson, who co-founded it with Pete. Brian and Pete will be talking about what’s new at BriarWorks, and how they are getting ready to attend the Chicago pipe show. (This was recorded before the show that took place last weekend.) At the top of the show, Brian will give his report of his travels and what happened at the Chicago show.

When I first started with the pipe as a quirky and precocious teen, the only tutelage I had at my disposal were scenes from old movies in which a well dressed chap would stick his pipe into a pouch, scoop tobacco into the bowl and press it down unceremoniously with his thumb. Then, with great flourish, he’d strike a match and light the thing with all manner of cinematic excess, puffing up vast clouds of smoke falling just short of completely obscuring his visage. While it may look good on film, it’s a terrible approach to actually enjoying the thing. Somehow, though, this “technique” seems to have survived in the contemporary vernacular, at least to some extent, even with bit-loads of information handily at our fingertips that should dissuade us from the practice. But, at the time, this misguided approach was all I had; it’s no wonder my early days of puffing were fraught with difficult lighting, harsh, bitter smokes and tongue bite, all culminating in a fireproof mass of ye old soggy dottle in the bottom of the bowl. Ultimately, the resulting frustration made me give up the pipe, at least for a while. While the idea of it was still very appealing, the practice of it was not. It wasn’t until a few years later when, still full of curiosity and romantic notions of pipe smoking, I wandered into a real tobacconist’s shop, and learned my “method” was a long way from the techniques that would bring me to any sort of pipe smoking bliss. So, after my poor start, and under the guidance of someone who actually seemed to know how to do it right, I was given the opportunity to approach the process anew, this time with much greater success. It was only because I was both perseverent, and fortunate to have a local shop staffed with knowledgeable people, that I’ve been able to enjoy the experience ever since. At least mostly… How many fledgeling pipe smokers have simply given up on an enjoyable pastime because of similar early mis-starts? Fortunately, today, it’s not hard to find helpful guidance at the press of a key or ten. But, at the same time, not all roads lead to Valhalla, and sometimes the advice offered might well be labeled with, “Here be dragons.” The other day, I came across a short video on-line in which a well-meaning tobacconist suggested packing a bowl of an “English” mixture “nice and tight.” Perhaps somewhat ironically, I was smoking, or trying to smoke a bowl that I’d filled on auto-pilot, packed too tightly, and not only was having the devil of a time trying to keep it lit, I really wasn’t enjoying the acrid smoke the tobacco issued during the brief periods in which it was actually burning. “No, no, NO!” I found myself muttering at my pipe, and at the figure on the screen, my protests joined by the guttural growling noises that sometimes accompany my discontent. Defiantly, I grabbed a pipe nail, shoveled out the dense, asbestos-like clog from the bowl, swabbed out the shank with a pipe cleaner, more out of habit than need since I hadn’t actually smoked enough of the mass to foul the shank, and started over, this time paying proper attention to what I was doing. (For as long as I’ve been doing this, I still screw it all up sometimes.) Much better. This got me thinking about a couple things that are so important to the maximal enjoyment of our pipes, yet not often enough discussed, namely how different tobaccos respond to variations in filling density, and moisture content; two separate but related parameters. Once I’d been shown the proper way to fill the bowl, or at least a proper way, everything had changed for me. I also began drying my tobacco down as a matter of course. Suddenly, there was greater cooperation between leaf and flame, the smoke was rich and flavorful, and it burned mostly to the bottom of the bowl with few relights. Given that, at the time, I smoked latakia mixtures almost exclusively, there didn’t seem to be a reason to explore beyond my “new” approach. It wasn’t until my attention turned in the direction of Virginia blends that I had to look a bit deeper. The same technique that worked so well for me with latakia mixtures resulted in bland, and often harsh smokes with Virginias. I attributed this to the tobaccos, convincing myself that I just didn’t like the stuff. At one of our pipe club meetings, I was talking with a friend who smoked Three Nuns exclusively. When he offered me a bowl. I thanked him, and told him that I just didn’t seem to get along well with Virginias, that they weren’t for me. “Maybe it’s the way you pack them. Here, let me fill your pipe for you.” I watched as he rubbed out a few coins to fine ribbons, moister than I was then accustomed to, and filled the bowl carefully in stages, pressing it tighter than I would have. Prepared for a nightmare, I was instead treated to a pipe dream. The tobacco smoldered slowly and almost continuously, delivering a rich, cool, sweet and delicious smoke. After that, I spent some time exploring the impact of these two variables, moisture content and packing density, on different mixtures and blends, always with similar results. Latakia mixtures, and to a lesser extent, those with a high percentage of oriental leaf, taste and smoke better when they’re on the dry side and the bowl is filled loosely, while Virginia blends tend to work best with a little more moisture and a denser fill. Burleys seem to work best somewhere in between, except for cube-cuts, which don’t like to be packed with much pressure at all. (Gravity fill, tap the bowl to settle the cubes. Repeat until full.) For such a simple act, pipe smoking is filled with undefined complexities! The point behind all this? Often […]

Welcome to The Pipes Magazine Radio Show Episode 604. Our featured interview tonight is with Jon David Cole. JD is the Owner/Tobacconist at The Country Squire in Jackson, MS, and he is the former co-host of the podcast, Country Squire Radio, which ended their 10-year run last year. We’ll have JD with the “From the Country Squire” segment talking about all the new things happening at the store and in the business in general. At the top of the show, we’ll continue our audio tour of Brian’s pipe collection.

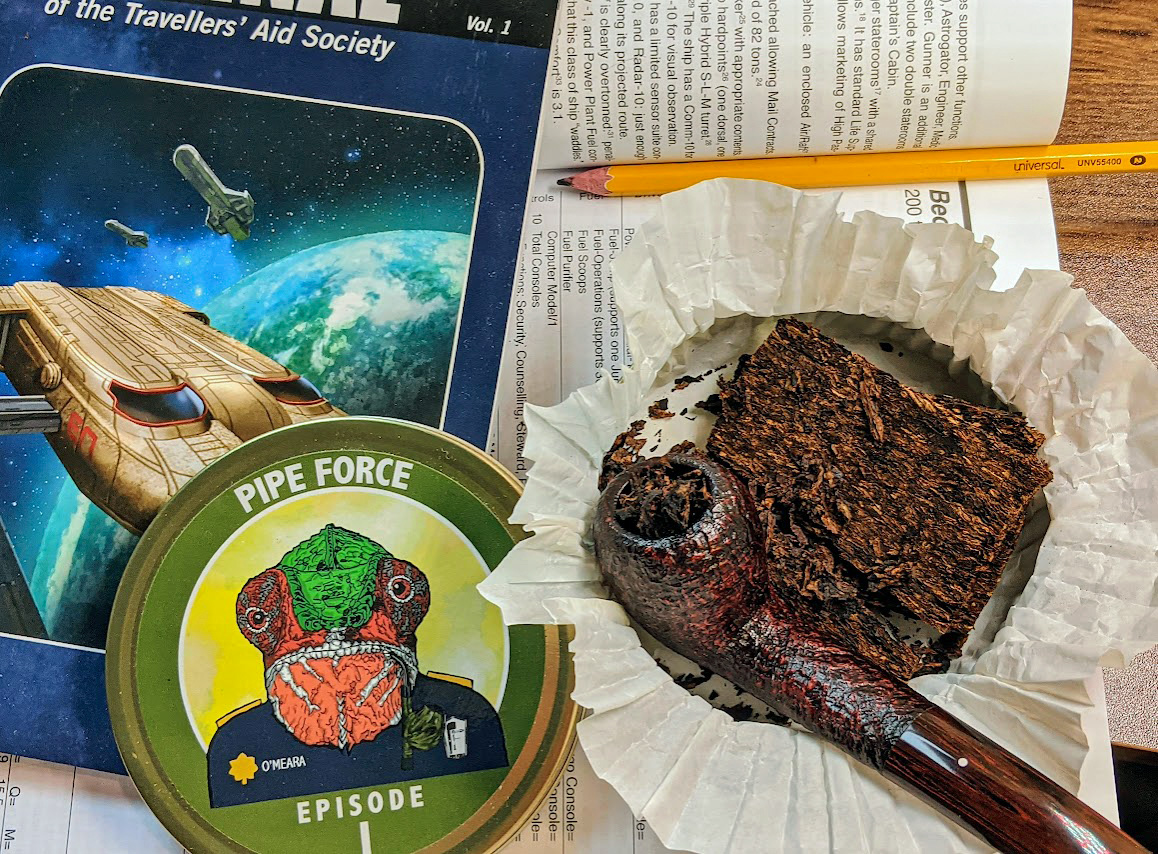

Before we begin, I should tell you: this tobacco review is being written by an A.I. Not the fancy new GPTs or their ilk; no, this is last century’s meat-and-bone, all-organic model. To be fair, a large part of what we call knowledge is merely the accumulated perceptions and impressions gathered from a life wandered through, synthesized into a spongy mass of what-it-is-that-we-think-that-we-know. The algorithm for this prompt is simple enough: pump thousands of bowls of smoldering plant matter into a gaping maw, cross-reference the chemical sensations with all other matter previously ingested or inhaled, sieve it all through the diffuse and fractal twin lens of memory and emotion, and churn out a panoply of adjectives that attempts to convey the sensations to someone who hasn’t experienced it yet. Odds are that a diligently trained monkey could succeed half the time; if this reviewer nears fifty-one percent then that would qualify as an unrivaled success. There must have been some similar musings perambulating through the mind of Per Jensen when he began his mad scientist routine at Sutliff with the Pipe Force project, which brings us to the current mixture under the microscope—Sutliff’s Pipe Force: Episode I. Here again are the unusual ingredients that engendered the series, with the stoved Rustica being the defining voice in this composition. From the tin: The Latakia-forward English mixture offers plenty of smoky flavor from the fire-cured leaf, which is artfully harmonized with floral, earthy Stoved Rustica. A mixture of high-grade Virginias imparts a natural sweetness. Katerini, the sole Oriental component, offers herb and spice notes bringing complexity and nuance to the flavor profile. It’s certainly Latakia-forward, with the stoved Rustica doubling up on the rhythm section like a second bassist. A first whiff from the tin releases the aromas of shoe leather and hide glue in a base of clay soil with a campfire wafted over it like last night’s beach party. Once it’s been accustomed to oxygen again, subtle hints of sweetness poke through from the Virginias: lemon rind, light milk chocolate, the dregs of a peaty Scotch, and muddled cherry. Old regulars like fresh-sawn oak and tilled earth are there, of course, with distinct notes of truffle, creosote, damp peat, and pine bark mulch. As an aside, I’ve been re-potting my camellias and the similarity of aroma to the ericaceous soil mix is notable; the Katerini really brings the unique depth of its vegetal complexion when supported by the Rustica and afforded more voice in the mix. The smoky Cyprian Latakia, in turn, is backed by equal earthiness from the Rustica, which overall exhibits a profile similar to dark-fired Kentucky; it leans more toward the woody and vegetal end of that spectrum, echoing and amplifying those traits of the other constituents. The tobacco is presented pressed and cut into a couple of thick, hearty flakes in the tin, lightly moist and easily crumbled to prepare—I prefer mine with a bit of drying time. The out-of-this-world tin art for this episode in the series is Major O’Meara smoking a cavalier. In the absence of confirmation, I’m going to hazard a guess he’s of the Ithklur species. The first taste from the light is sweet, with hints of that milk chocolate dancing around the edges. The Virginia leads the smoke through the top of the bowl, and orchestrates it well. Thoroughly smoky with lemony, grassy highlights from the Virginia spectrum, it soon segues into the mid-bowl profile: heartier, smokier, with the flavor leaning to the mildly acrid and tangy tinge that is the campfire-esque signature of English blends. Caution advised, it can turn overly bitter if pushed—this is where one’s sipping technique is required to maintain the fullness of flavor through to the heel. I did tend toward a lot of relights, though it may have as much to do with technique as with the blend. Pacing is also important as the nicotine starts to manifest; though the Rustica’s contribution has been tempered well by the stoving, it can certainly upend an empty stomach. At the end of every bowl, the mouthfeel somehow gets better. The balance of sugars in the tobaccos would seem to be spot-on in this regard. I started out my tasting in cobs, then cut short an unpleasant bowl in a meer, and finally landed on my best instrument with the lovely Dunhill 4427 pictured, a quaint group 4 shell briar with a gentle curve and Cumberland stem supporting a perfectly executed acorn bowl. It surprised me here, as I’ve learned through the years that I generally have the best experience with English blends in large, wide bowls. With this blend it seems that to get the best out of the Katerini’s somewhat diaphanous influence the smaller bowl fared much better. Room note is very English, so the company you keep will either love it or hate it, and it doesn’t linger too much. I find it paired best with a strong coffee; Sumatran beans complement the flavors well, as do Ethiopian if a lighter brew is preferred. Overall impressions of the blend are that it’s a curiously interesting take on the English genre, almost a reductive reconstruction of the theme using the unique components. This blend, if nothing else, expanded my vocabulary of sense perceptions with the uniquely treated leaf. While the average human can distinguish approximately one trillion (1,000,000,000,000!) different aromas, multiplied by seven basic tastes, and wholly dependent on variables from body chemistry to atmospheric conditions, our overworked and underpaid simian brains can’t effectively catalog them all. Our pet adding machines are exceedingly good at this, however, and someday soon they’ll be the ultimate and unequivocal authority on what something tastes, smells, looks, or even feels like. Until that time, friends, revel in the moments that can be stolen to savor over a bowl of Pipe Force: Episode I.

Welcome to The Pipes Magazine Radio Show Episode 603. Our featured interview tonight is with Rick Newcombe. Rick is a well-known author of several pipe books, and he is currently working on his third book. He is a prominent collector of Danish pipes, and vintage tobaccos. He has traveled the world visiting pipe makers, and learning their different techniques. He is also the founder and chairman of Creators Syndicate, which currently represents more than 200 writers and artists. At the top of the show we’ll have a Pipe Smoking 101 segment discussing best pipe shapes and sizes that are best suited to certain types of tobacco.